Product infographic carousel

Product infographic images

Product Infographic captions

-

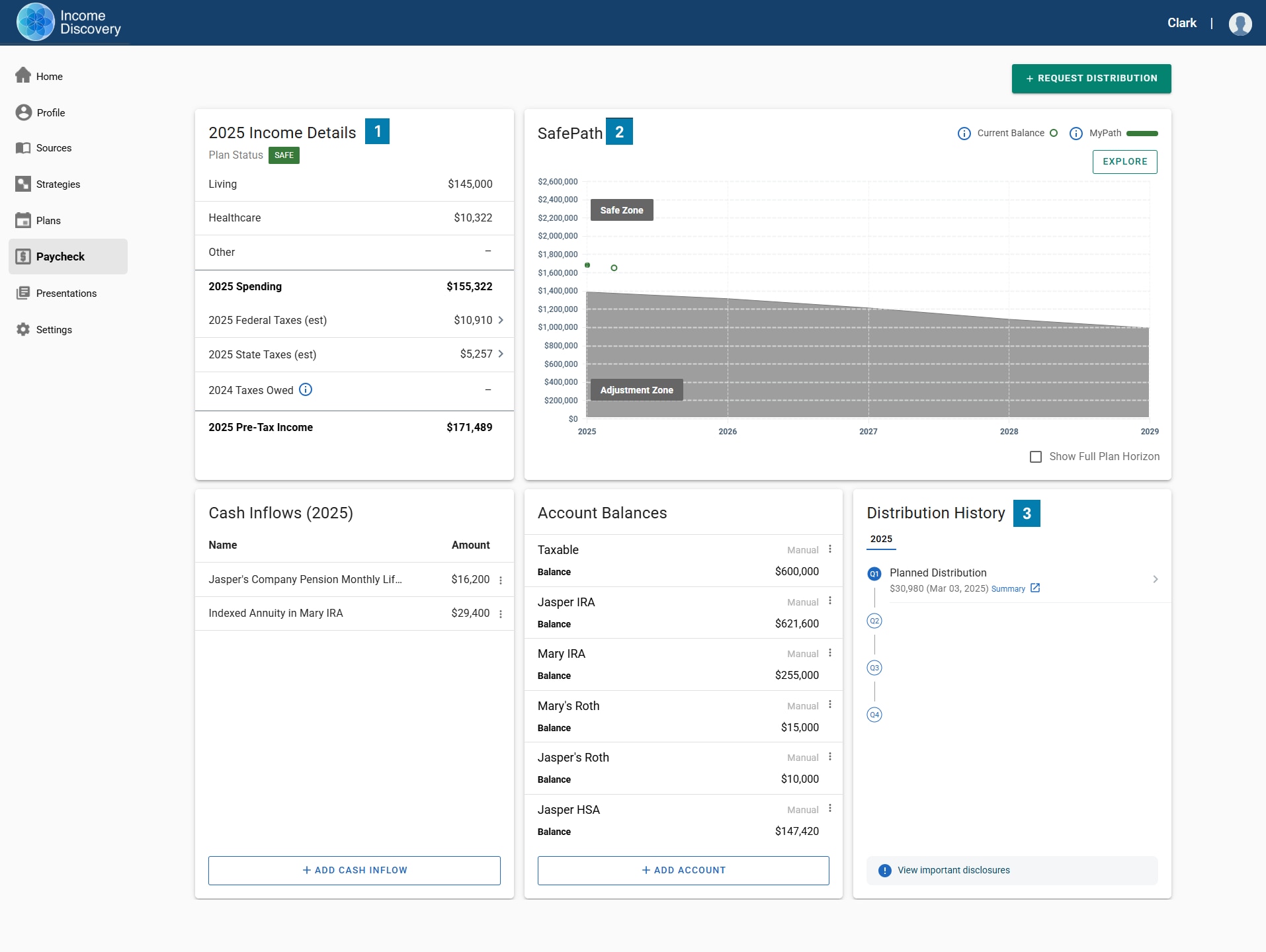

1

In Paycheck, an advisor reviews and confirms current year income details, estimated taxes, cash flows and account balances before requesting a distribution.

-

2

An advisor uses SafePath(SM) to track the plan’s safety and monitor income adjustments, if necessary.

-

3

In Paycheck, an advisor can request a planned distribution, unplanned distribution, Roth conversion, or evaluate tax-free capital gains opportunities. View details of accepted distributions in the History card.

-

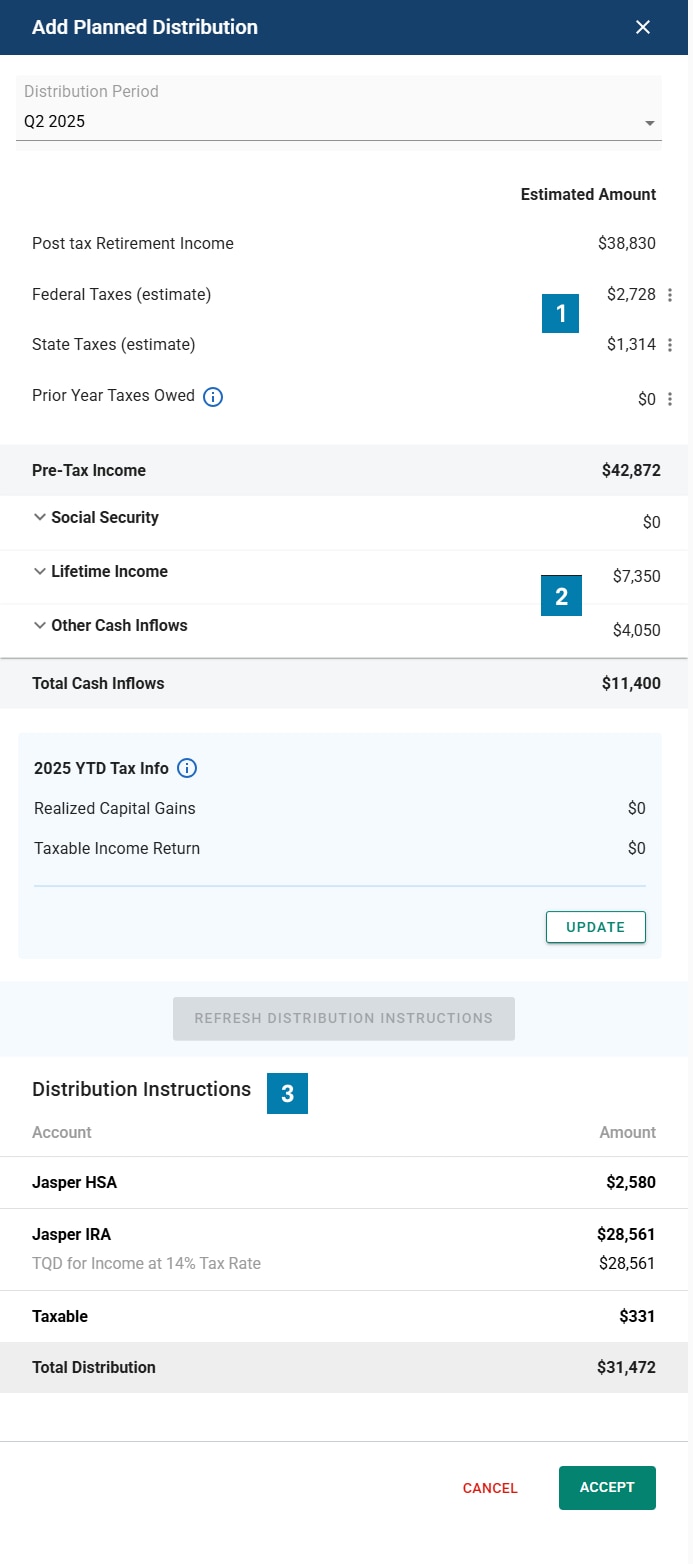

1

An advisor reviews the tax estimates and makes edits if necessary.

-

2

Reviews the household’s incoming cash flows expected for the year.

-

3

Views the recommended tax-optimal account-level instructions for the household’s planned quarterly distribution The advisor selects the Accept button to accept the recommendation.

-

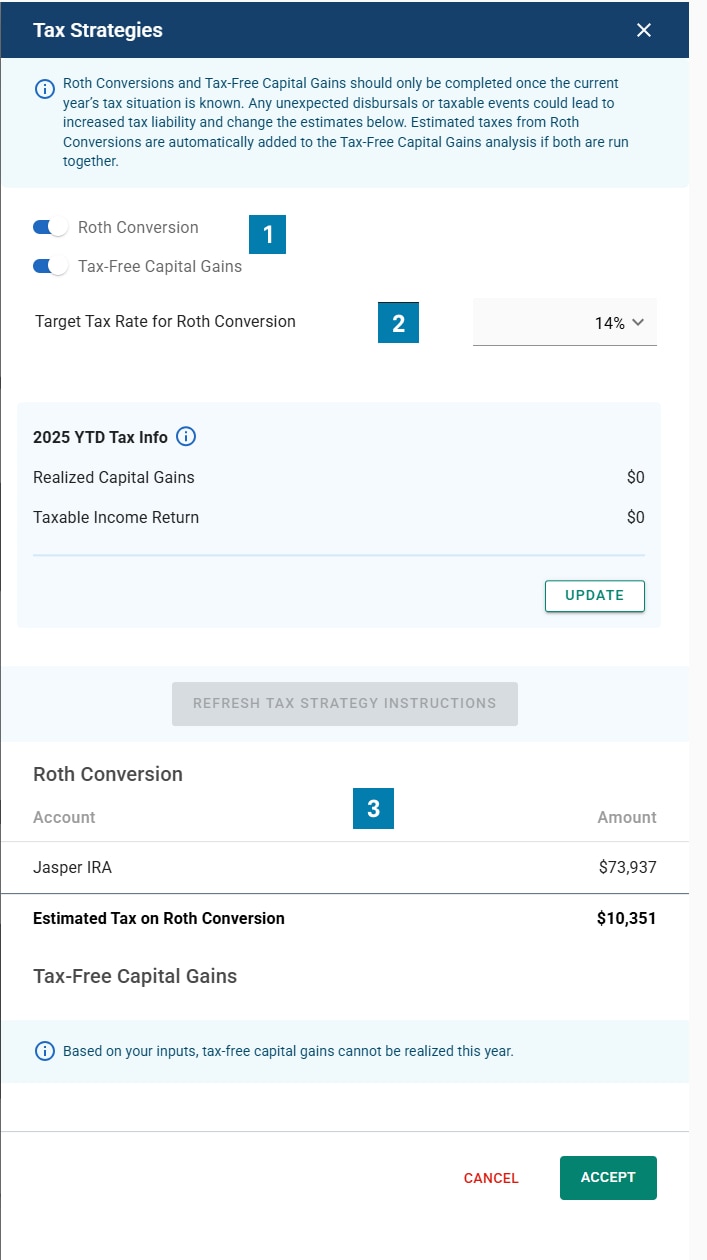

1

Toward the end of the year, an advisor can evaluate two tax strategies: 1) if a Roth conversion should be done and 2) if there is an opportunity to harvest any Tax-free Capital Gains in the client’s taxable accounts.

-

2

The optimal incremental effective tax rate for Roth conversions was agreed upon when the plan was selected for Paycheck.

-

3

The advisor views the recommended account-level instructions for any Roth conversions and tax-free capital gains. The advisor selects the Accept button to accept the recommendations.

Product Description

About this Product

Paycheck is a tax-optimized solution to manage disbursals for planned spending, unplanned spending and Roth conversions during retirement:

- Holistic, flexible, & integrates with existing tools/systems

- Advisors create & monitor personalized paychecks for clients

- Safety tracking & automated income adjustments are included

About Income Discovery

Income Discovery simplifies retirement income distribution to provide clients a personalized tax-optimal paycheck in retirement. Its intelligent engine, AIDA, combs through thousands of options to determine a personalized optimal strategy for each retiree. AIDA discovers the precise plan that aims to increase a retiree’s paycheck by as much as 30% or increase a retiree’s after-tax legacy by 5 times. AIDA systematizes the delivery of tax-optimal paycheck in retirement for scalable delivery to millions of households. It has already delivered a Full & Rich Retirement to more than 148,000 retirees with $150 billion in assets as of 12/31/24.

Other Products from Income Discovery

Product Details

Contact Us

More info about us

0719-93C0

API integration is available through Schwab OpenView Gateway®, which is provided by Performance Technologies, Inc. (“PTI”). Single sign-on is provided by PTI. Daily data files and trading integration are available through Charles Schwab & Co., Inc. ("CS&Co"), a registered broker-dealer and member SIPC. Not all third party providers listed on this site have integration agreements with Schwab. Schwab OpenView Gateway® is a service of PTI.

References to third parties on this site (whether such parties are vendors participating in a service of PTI or independent advisors using a service of a participating vendor) are not an endorsement or recommendation of, or an opinion (favorable or unfavorable), or advice about, or a referral to any product or service of any third party. Advisors are solely responsible for evaluating, selecting, and purchasing products and services offered by third party vendors. Unless indicated otherwise, third parties are independent and not affiliated with PTI or its affiliates.

Schwab Advisor Services includes the custody, trading, and support services of Charles Schwab & Co., Inc. ("CS&Co"), a registered broker-dealer and member SIPC, and the technology products and services of PTI. PTI and CS&Co are separate companies affiliated as subsidiaries of The Charles Schwab Corporation, but their products and services are independent of each other. PTI’s integration solutions integrate data about accounts custodied at CS&Co.

Access to Electronic Services may be limited or unavailable during periods of peak demand, market volatility, systems upgrade, maintenance, or for other reasons.