Product infographic carousel

Product infographic images

Product Infographic captions

-

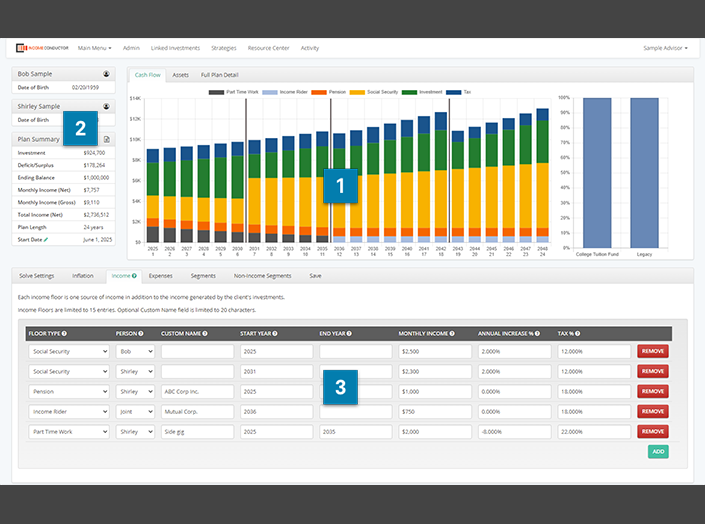

1

Use the dynamic income plan editor to design customized, time-segmented income plans collaboratively with your client. Create plans that are basic illustrations, all the way to sophisticated, comprehensive retirement road maps.

-

2

See updates to important plan analytics in real-time as you work. Give your client instant feedback on the impact of various scenarios and decisions, such as retirement date, rate-of-return assumptions, and social security claiming strategies.

-

3

Build out the income need at the budget level using individual expenses that can each vary over time. Include all other sources of income, such as Social Security, Pensions, Part Time Work, and more.

-

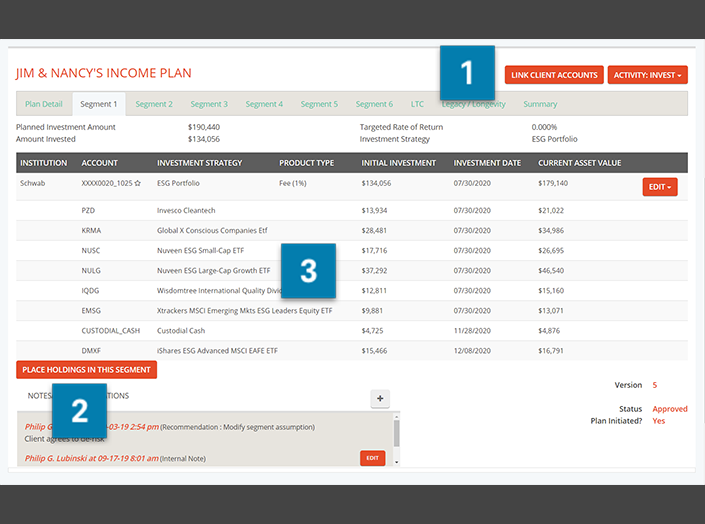

1

Import households of client accounts through our direct data integrations with services like Albridge, Orion, custodians like SEI and TD Ameritrade, or our broad aggregation service Plaid. Connect client assets from anywhere they are held.

-

2

Link client assets to plan segments at the account level, sleeve/sub-account level through UMA platforms like E*Trade Advisor Services, Orion, SEI, and Adhesion, or at the individual position level to easily implement plans for tracking in retirement.

-

3

Receive daily updates to accounts, positions and values ensures that you have compliant, up-to-date asset data flowing into IncomeConductor. Easily swap accounts and positions in, out, or between segments if investment adjustments need to be made.

-

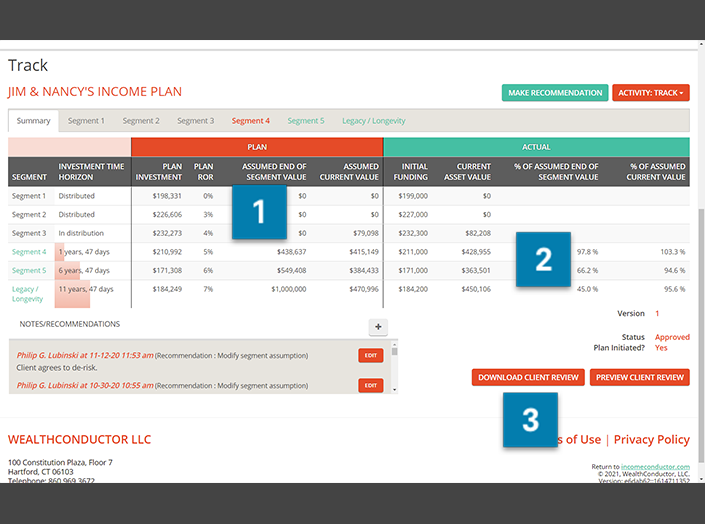

1

IncomeConductor calculates how your client’s income plan should be progressing every day, giving you the automation to administer dozens or hundreds of plans at once. Scale your practice knowing that IncomeConductor is working for you in the background.

-

2

See how actual investment values stacks up against the assumptions and projections from the original plan. See what the Required Rate of Return for each segment to reach its growth goals and fully fund planned client income every day.

-

3

Receive automated de-risking alerts when there are opportunities to potentially reduce market exposure while still staying on track to fully funding future income. Run review reports with a single click to quickly illustrate your client’s progress.

Product Description

About this Product

Advisor software to create customized, time-segmented retirement income plans:

- Tool for advisors to create time-segmented retirement income plans

- Plans can be easily tracked and managed throughout retirement

- Provides written plan giving retirees the peace of mind they deserve

About WealthConductor LLC

WealthConductor LLC was co-founded in 2017 by CEO Sheryl O’Connor along with partners Phil Lubinski, CFP®, and Tom O’Connor to develop retirement planning software called IncomeConductor focused on the advisor space. The company is passionate about providing an income distribution strategy that serves the needs of enterprise firms and financial advisors in meeting the challenges they face in service to their clients. Our revolutionary retirement income software provides a complete suite of support to financial advisors who want to re-define their value proposition as retirement income professionals and provide a time-tested income distribution strategy to their clients that is completely customized to their individual needs and goals. We partner with our community of advisors to continuously enhance our technology and supporting programs to help them succeed in the income distribution market.

Product Details

Contact Us

More info about us

0719-93C0

API integration is available through Schwab OpenView Gateway®, which is provided by Performance Technologies, Inc. (“PTI”). Single sign-on is provided by PTI. Daily data files and trading integration are available through Charles Schwab & Co., Inc. ("CS&Co"), a registered broker-dealer and member SIPC. Not all third party providers listed on this site have integration agreements with Schwab. Schwab OpenView Gateway® and Schwab OpenView MarketSquare™ are services of PTI.

References to third parties on this site (whether such parties are vendors participating in a service of PTI or independent advisors using a service of a participating vendor) are not an endorsement or recommendation of, or an opinion (favorable or unfavorable), or advice about, or a referral to any product or service of any third party. Advisors are solely responsible for evaluating, selecting, and purchasing products and services offered by third party vendors. Unless indicated otherwise, third parties are independent and not affiliated with PTI or its affiliates.

Schwab Advisor Services includes the custody, trading, and support services of Charles Schwab & Co., Inc. ("CS&Co"), a registered broker-dealer and member SIPC, and the technology products and services of PTI. PTI and CS&Co are separate companies affiliated as subsidiaries of The Charles Schwab Corporation, but their products and services are independent of each other. PTI’s integration solutions integrate data about accounts custodied at CS&Co.

Access to Electronic Services may be limited or unavailable during periods of peak demand, market volatility, systems upgrade, maintenance, or for other reasons.