Product infographic carousel

Product infographic images

Product Infographic captions

-

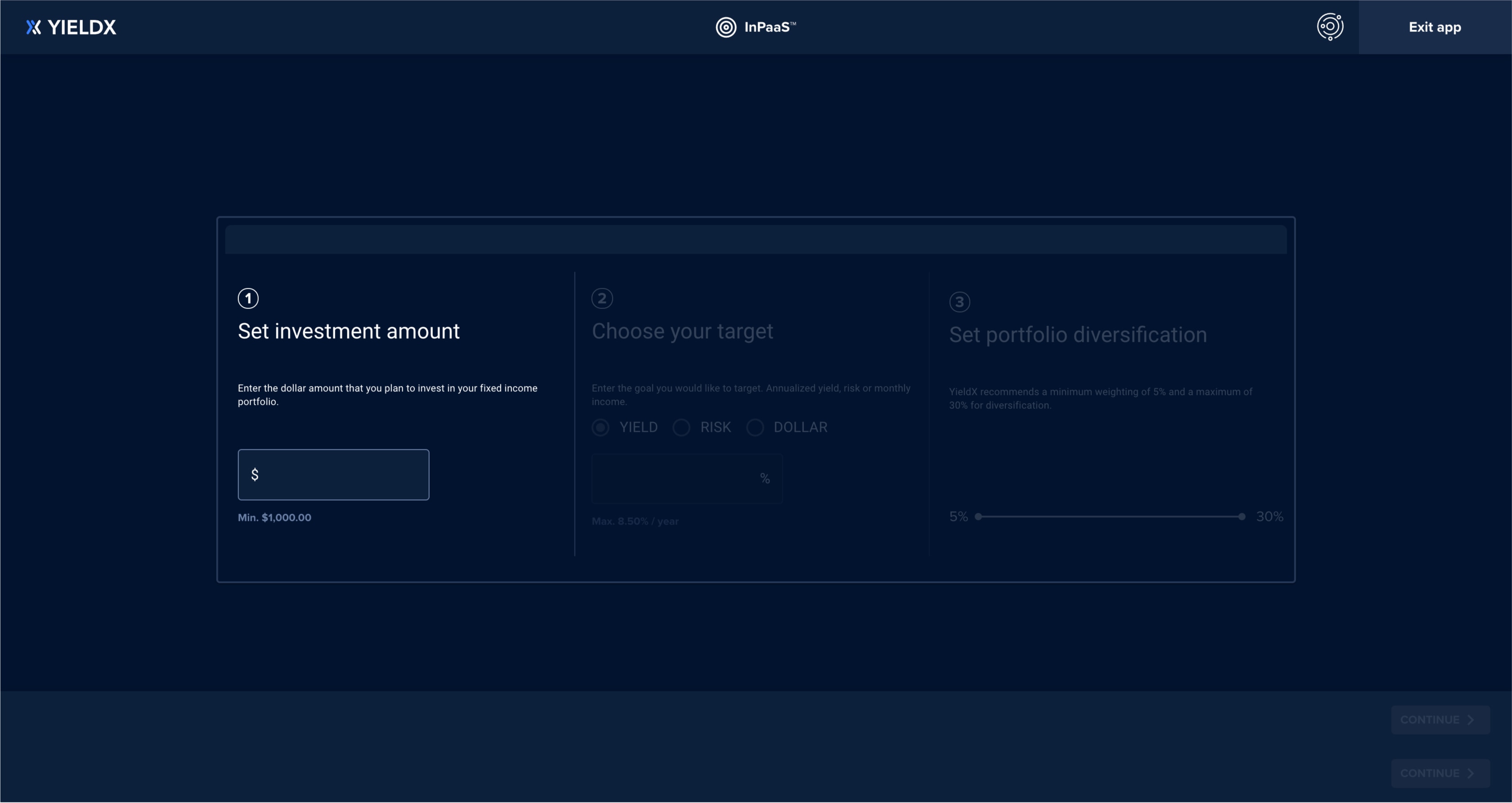

1

With 3 simple user inputs, deploy powerful optimization algorithms to analyze and filter a universe of more than 650 fixed income ETFs and CEFs that manage over $1.255 trillion in assets.

-

2

Dynamically construct a portfolio that achieves the desired yield while minimizing risk and expense ratios.

-

3

InPaaS is available within the YieldX platform, accessible via API, or can be embedded into your existing tech stack.

-

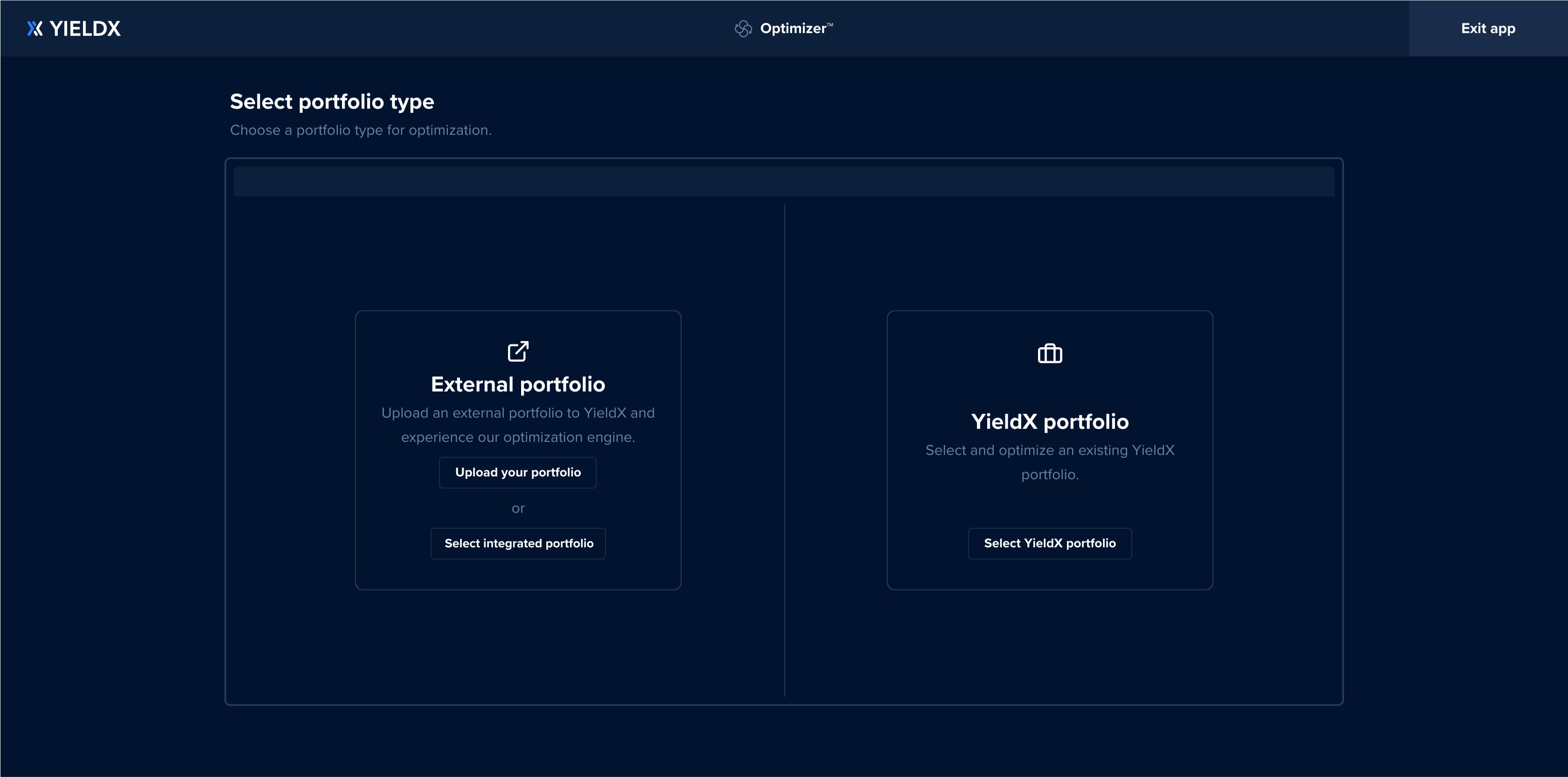

1

YieldXs Optimizer solution deploys optimization algorithms to identify opportunities within existing fixed income portfolios to improve the portfolio's overall yield or reduce the portfolio's volatility.

-

2

With YieldX, optimize your portfolio with actionable trade enhancements

-

3

Optimizer is available within the YieldX platform, accessible via API, or can be embedded into your existing tech stack.

-

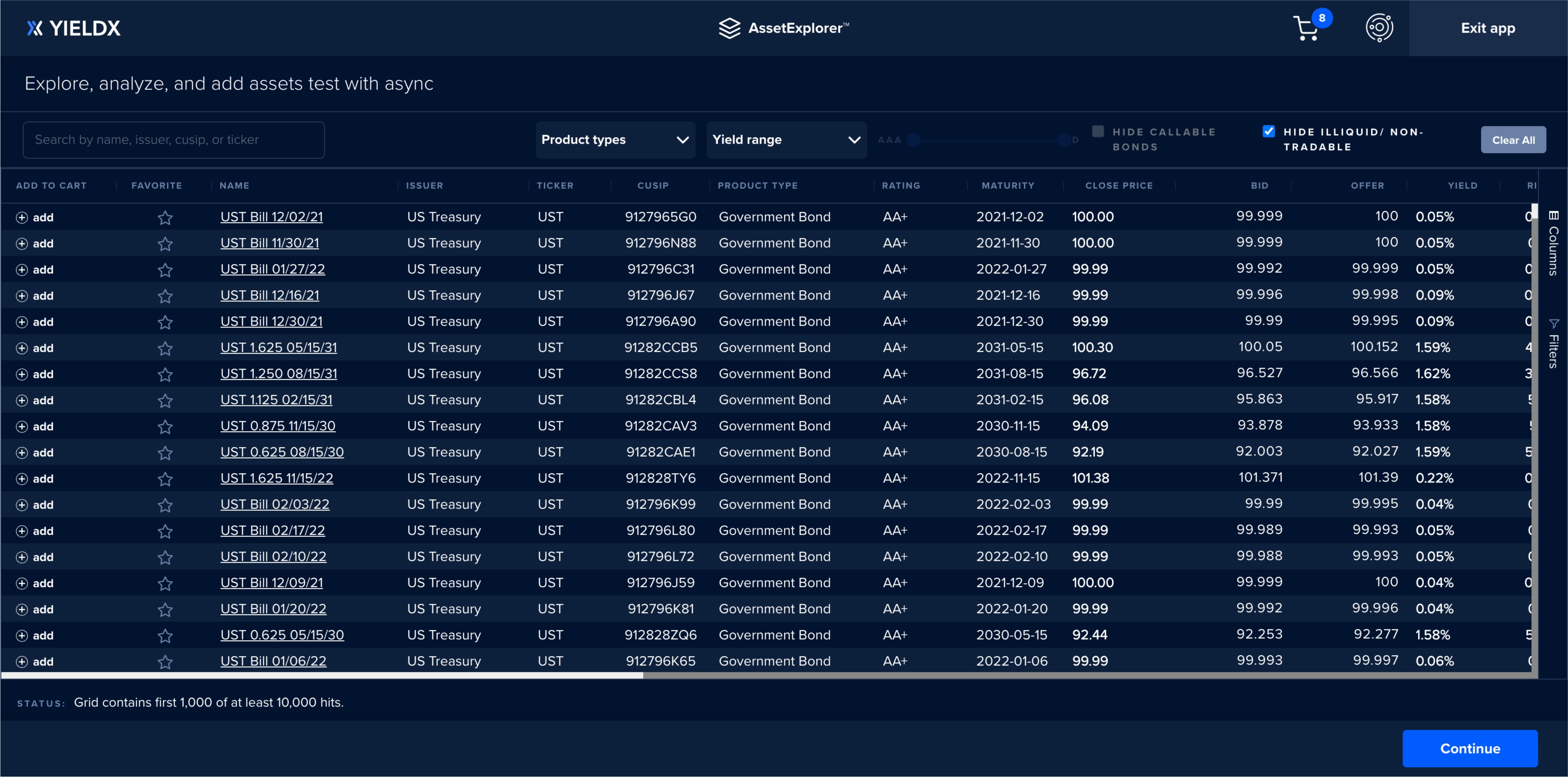

1

Access real time indicative pricing, customizable filters, monitoring and portfolio allocation solutions across corporate, municipal, and government bonds, fixed income ETFs, closed end funds, preferreds, and mutual funds.

-

2

For investors and wealth managers who wish to enhance and simplify the process of finding yield, AssetExplorer offers a unique search experience.

-

3

AssetExplorer is available within the YieldX platform, accessible via API, or can be embedded into your existing tech stack.

Product Description

About this Product

B2B platform opening up fixed income investing to all investors:

- InPaaS: Target a specific yield, risk or dollar distribution

- Optimizer: Optimize your portfolio with actionable trade enhancements

- Asset Explorer: Search, filter, and sort through 2 million yield driven securities

- Best Fit: Build personalized corporate bond portfolios

- Ladder Builder: Create a bond ladder portfolio in seconds

About YieldX, Inc.

YieldX is reimagining fixed income. YieldX offers a digital-native API-first analytics and modeling platform. Our no quant' apps are transforming the way everyone from wealth managers to broker-dealers and fintech apps design and deliver optimized, personalized income investing solutions at scale. YieldX offers complete flexibility, with a choice of end-to-end technology and asset management solutions, custom investment universes, and white-labeled offerings, so clients can select the capabilities that best meet their needs.

Product Details

Contact Us

More info about us

0719-93C0

API integration is available through Schwab OpenView Gateway®, which is provided by Performance Technologies, Inc. (“PTI”). Single sign-on is provided by PTI. Daily data files and trading integration are available through Charles Schwab & Co., Inc. ("CS&Co"), a registered broker-dealer and member SIPC. Not all third party providers listed on this site have integration agreements with Schwab. Schwab OpenView Gateway® and Schwab OpenView MarketSquare™ are services of PTI.

References to third parties on this site (whether such parties are vendors participating in a service of PTI or independent advisors using a service of a participating vendor) are not an endorsement or recommendation of, or an opinion (favorable or unfavorable), or advice about, or a referral to any product or service of any third party. Advisors are solely responsible for evaluating, selecting, and purchasing products and services offered by third party vendors. Unless indicated otherwise, third parties are independent and not affiliated with PTI or its affiliates.

Schwab Advisor Services includes the custody, trading, and support services of Charles Schwab & Co., Inc. ("CS&Co"), a registered broker-dealer and member SIPC, and the technology products and services of PTI. PTI and CS&Co are separate companies affiliated as subsidiaries of The Charles Schwab Corporation, but their products and services are independent of each other. PTI’s integration solutions integrate data about accounts custodied at CS&Co.

Access to Electronic Services may be limited or unavailable during periods of peak demand, market volatility, systems upgrade, maintenance, or for other reasons.