2022 International Bonds Outlook: Neutral, for Now

The dominant trend in the international bond markets for 2022 is the prospect of gradually tightening monetary policy. Tighter policy is being signaled by the Bank of Canada (BOC) and the Federal Reserve over the next year, while the Bank of England (BOE) surprised markets with a rate hike on December 16, 2021. Emerging-market (EM) central banks are even farther ahead. Leading the way, Brazil and Russia started hiking rates in the spring of 2021. This shift toward tighter global monetary policy is a key reason why global rates moved up and yield curves steepened in many countries in 2021.

Yield curves should flatten in 2022 as policy rates rise. Flatter yield curves could be a plus for returns, but lingering inflation and the slowdown in China are risks that will likely outweigh this. This isn’t the best news for the international bond markets, but it may set up opportunities down the road, and as such we maintain a neutral outlook.

Developed-market bond outlook

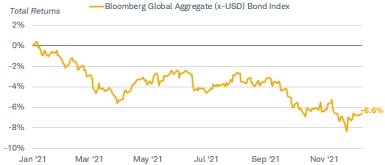

Developed-market (DM) yields are on track to end 2021 higher as the economic outlook improved, inflation spiked, and central banks signaled rate hikes for 2022. Given that duration (a measurement of the variation in a bond’s price with changes in interest rates) sits at a high 8.3 years, it should come as no surprise that the Bloomberg Global Aggregate (x-USD) Bond Index is down 6.6% year to date.

Global bonds lost ground in 2021

Source: Bloomberg. Bloomberg Global Aggregate (x-USD) Bond Index (LG38TRUU Index). Daily data from 1/1/2021 to 12/10/2021. Past performance is no guarantee of future results.

We expect 2022 could be another challenging year for developed-market bonds. Global bond yields are generally lower than those offered in the U.S., and a strong dollar pulls returns even lower. Those looking for income are unlikely to find it in global bonds, but consider maintaining exposure for the diversification benefits.

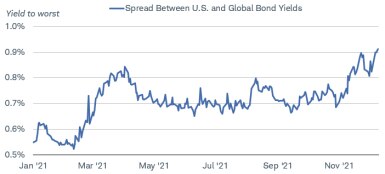

When looking at global bonds, the Eurozone and Japan are crucial to watch because they account for 60% of the Bloomberg Global Aggregate (x-USD) Bond Index—the Eurozone makes up 37% and Japan makes up 23%. Both central banks are expected to keep rates on hold over the next year. This means that inflation and growth expectations will have to do much of the heavy lifting to push their bond yields to levels that are more attractive than Treasuries. In today’s environment, this is a tall order to fill. Currently, the yield advantage of the Bloomberg U.S. Aggregate Bond Index over the Bloomberg Global Aggregate (x-USD) Bond Index is near 1%.

The yield advantage in U.S. bonds over global bonds has trended up recently

Note: The spread between U.S. and global bond yields is calculated as the difference in the yield to worst for the Bloomberg U.S. Aggregate Bond Index and the Bloomberg Global Aggregate (x-USD) Bond Index.

Source: Bloomberg. Bloomberg U.S. Aggregate Bond Index and Bloomberg Global Aggregate (x-USD) Bond Index (LBUSTRUU Index, LG38TRUU Index). Daily data as of 12/10/2021. Past performance is no guarantee of future results.

While the current outlook suggests continued outperformance by the U.S. bond market, we are watching for a change in fundamentals as an opportunity for global bonds potentially to become more attractive. One of those fundamentals is a change in the direction of the dollar. The tables could turn if the dollar weakens in 2022. Over the long run, the large U.S. current account deficit should pull the dollar lower. The current account deficit measures the amount that U.S. imports exceed exports in trade with the rest of the world. The deficit typically leads the dollar by two years, which suggests that by mid-2022 some weakness could emerge, especially if growth outside the U.S. picks up.

Historically, the current account deficit level has led the direction of the dollar

Source: Bloomberg. The Federal Reserve Trade Weighted Dollar and the U.S. Current Account Balance as a Percent of GDP (USTWBGD Index, EHCAUS Index). Quarterly data as of June 2021.

As for the yield differential, the use of lockdowns to combat COVID-19 in foreign developed economies should fade with time, presenting an opportunity for developed-market growth to catch up with the U.S. As such, the current median expectation for real gross domestic product (GDP) growth in 2022 is 3.9% for the U.S. and 4.2% for the Eurozone. We are monitoring this closely as it should flow through to higher global yields, narrowing the gap between the U.S. and DM markets. When the spread between U.S. yields and DM yields declines and/or the dollar weakens, global bonds should be more attractive.

Emerging-market bond outlook

We maintain our neutral outlook in emerging-market (EM) bonds, but are closely watching the rising risks. EM central banks have been raising rates since the spring of 2021, moving sooner and faster than DM central banks. Russia, Brazil, and Mexico are key EMs that have already hiked rates multiple times due to soaring inflation and falling currencies.

Inflation has risen in Brazil, Mexico, and Russia

Source: Bloomberg. Brazil CPI IPCA YoY, Mexico CPI YoY, and Russia CPI YoY (BZPIIPCY Index, MXCPYOY Index, RUCPIYOY Index). Monthly data as of 11/30/2021.

Inflation in EM economies is currently high due to energy and food prices, which make up a larger portion of their consumption basket compared with DM economies. Higher inflation generally means weaker currencies. Weaker currencies historically lead to poor bond performance—either from direct currency exposure with local currency bonds, or indirectly through the rising cost of sourcing dollars to make debt payments on dollar-denominated bonds.

Pair the strong rise in inflation rates with the recent credit crunch in China, and the outlook is worse. As China’s property sector goes through a liquidity crisis, we are seeing ripple effects in commodities and downgrades to the growth forecast for other EM countries. Iron ore and steel rebar prices have declined due to the contraction in China’s property sector.

Prices of iron ore and steel rebar have declined

Source: Bloomberg. Generic 2nd Contract for DCE Iron Ore Futures and Generic 2nd Contract for SHFE Steel Rebar Futures (IOE2 Comdty, RBT2 Comdty). Daily data as of 12/13/2021. Past performance is no guarantee of future results.

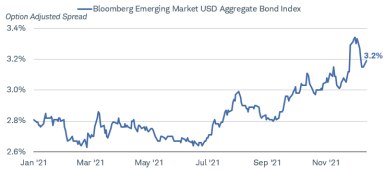

The risks are high for EM bonds. Slowing growth, rising inflation, and weaker currencies will continue to weigh on EM bond performance in 2022. Spreads are set to end the year significantly wider than where they started, reflecting investors’ demand for compensation for these risks.

EM bond spreads are trending up, reflecting the rising risks

Source: Bloomberg. Bloomberg Emerging Market U.S. Dollar Aggregate Option Adjusted Spread Index (EMUSOAS Index). Daily data as of 12/13/2021. Past performance is no guarantee of future results.

On the positive side, the yield emerging-market bonds offer over U.S. Treasuries is still near 3.2%, which is high in today’s low-yield environment. If you can ride out the volatility and focus on the income, you may benefit from investing in EM bonds over the long run. Therefore, we remain neutral on EM bonds in the face of higher risks.

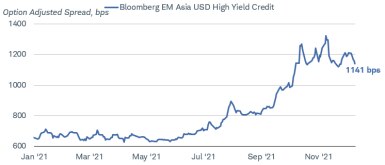

Keep an eye on China

The real wild card for international bonds and markets alike is China. China’s economy is currently in a cyclical slowdown and the property sector is getting squeezed, leading to minor spillover effects. Spreads have widened considerably for the Bloomberg Emerging Market Asia High Yield Corporate Index.

China’s property sector credit crunch led to wider spreads in the Asian HY bond market

Source: Bloomberg. Emerging Market Asia USD High Corporate Bond Index (I20913US Index). Daily data as of 12/10/2021. Past performance is no guarantee of future results.

China could choose to surprise the markets by shifting to a more broad-based stimulus approach in 2022, but Beijing has made it abundantly clear that stimulus will be targeted over the near term. That suggests China is unlikely to cut the lending rate or enact sweeping stimulus. Instead, it is targeting smaller businesses and consumers to bring “prosperity to all” and redistribute wealth. As for the property sector, China is helping companies restructure their debt and downsize their outsized economic impact on GDP going forward. Our base case is for the decline in credit growth to bottom in the first half of 2022, but we still expect China’s current policy stance to hinder global growth, commodity prices, and emerging-market bond performance in 2022.

What to do now

Our outlook is neutral for both EM and DM bonds in 2022. A weaker dollar or rising global bond yields could present an opportunity in the future for DM bonds, but for now, yields are too low and the dollar too strong. EM bonds are slightly more attractive than DM bonds given their additional yield, but risks are elevated, and volatility is high. EM countries will need to get inflation under control before their currencies strengthen against the dollar again. Consider staying the course in EM bonds and you may be rewarded with potentially higher yields over U.S. bond yields in the long run.

Given the underperformance of international fixed income investments so far in 2021,1 consider using a dollar-cost averaging strategy when allocating new money into DM or EM bonds. Dollar-cost averaging involves investing each contribution in accordance with target weights over time-irrelevant of recent performance. By making regular investments no matter whether prices are up or down, you will essentially purchase more securities when they’re “on sale” and fewer after prices jump. This should help position your portfolio for a potential rebound in international fixed income.

1 Year-to-date total returns for the Bloomberg Global Aggregate (x-USD) Bond Index and the Bloomberg Emerging Market USD Aggregate Bond Index are through 12/10/2021

Follow the Schwab Center for Financial Research on Twitter: @SchwabResearch.

Talk to us about the services that are right for you. Call a Schwab Fixed Income Specialist at 877-566-7982, visit a branch, find a consultant or open an account online.

Explore Schwab’s views on additional fixed income topics in Bond Insights.

Important disclosures

Investors should consider carefully information contained in the prospectus or, if available, the summary prospectus, including investment objectives, risks, charges, and expenses. Please read it carefully before investing.

The information provided here is for general informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third-party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed.

Past performance is no guarantee of future results and the opinions presented cannot be viewed as an indicator of future performance.

Indexes are unmanaged, do not incur management fees, costs and expenses and cannot be invested in directly. For more information on indexes please see schwab.com/indexdefinitions.

Fixed income securities are subject to increased loss of principal during periods of rising interest rates. Fixed-income investments are subject to various other risks including changes in credit quality, market valuations, liquidity, prepayments, early redemption, corporate events, tax ramifications and other factors. Lower-rated securities are subject to greater credit risk, default risk, and liquidity risk.

Diversification and asset allocation strategies do not ensure a profit and do not protect against losses in declining markets.

International investments involve additional risks, which include differences in financial accounting standards, currency fluctuations, geopolitical risk, foreign taxes and regulations, and the potential for illiquid markets. Investing in emerging markets may accentuate these risks.

Source: Bloomberg Index Services Limited. BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg’s licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

Commodity-related products carry a high level of risk and are not suitable for all investors. Commodity related products may be extremely volatile, illiquid and can be significantly affected by underlying commodity prices, world events, import controls, worldwide competition, government regulations, and economic conditions.

Currencies are speculative, very volatile and are not suitable for all investors.

Periodic investment plans (dollar-cost-averaging) do not assure a profit and do not protect against loss in declining markets.

The Schwab Center for Financial Research is a division of Charles Schwab & Co., Inc.