6 tips for getting through to stressed-out clients

Key Points

-

Your clients likely have one thing in common: they're stressed. According to Dr. Coughlin, the stress clients feel can be the single biggest hurdle for planning their futures.

-

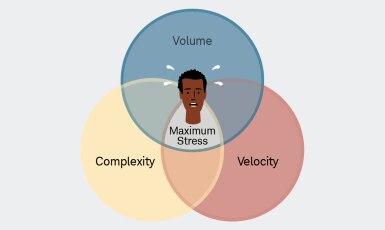

While stress is often based on circumstances, there are universal forces that contribute to stress: volume, velocity, and complexity.

-

Understanding the stressors clients face can help you break through to them, making the financial planning process just a little less stressful.

Baby boomers, Gen X, Millennials, Gen Z—each generation has its own unique way of looking at the world, client service expectations, and communication styles. However, Dr. Joseph F. Coughlin, founder and director of the MIT AgeLab, says there's a common thread that pulls together clients of all ages: They're really stressed out.

The vast majority of Americans (76%) say they've suffered health impacts due to stress in the past month.1 And while Gen Z is most likely to say it's stressed, Baby Boomers, Gen Xers and Millennials all report experiencing unhealthy stress levels, consistently and over long periods.

Why does this matter? According to Coughlin, the stress clients feel is the single biggest hurdle to planning for their futures. He believes that by taking some of the stress out of financial planning, advisors can help a wide range of clients take proactive steps to plan for life events, especially retirement. The first step is to understand what causes stress.

How did everyone get so stressed?

We tend to think of stress as rooted in circumstances. For example, stressed millennials often have young children and are building their careers, so most people assume that once the children are older or the career reaches a certain level, they'll experience less stress.

However, circumstances aren't necessarily the primary cause of stress. Stress is more about how we perceive the demands on us. Coughlin sees three main forces contributing to stress:

1. Volume

The number of issues that demand our attention seems to rise each day; we are dealing with more choices and more to manage than ever. As the number of options rises, the level of engagement often falls. In our brains, "more" becomes overwhelming and oppressive instead of liberating.

2. Velocity

Technology has improved our lives in countless ways. But it has also greatly increased expectations of how fast we, and others, should be able to get things done. All of us feel more pressure than ever to do it, all of it, right now.

3. Complexity

The never-ending flow of new, often conflicting, information and opinions creates more uncertainty and doubt. Many approved standards for how we should live our lives—from nutritional guidelines such as the food pyramid to the percentage of our income we need to save to retire comfortably—seem to change from week to week. This lack of clarity causes most people to stress out, shut down, and do nothing rather than risk taking the "wrong" action.

The stress that these three forces create changes how we process and scan for information, says Coughlin. Stressed-out clients, for example, may only see what's in front of them. They may ask for more information from their advisors when the markets are tumbling, but their brains become unable to process it as they go into classic fight-or-flight mode.

In the face of this volume, velocity, and complexity each day, it's hardly surprising that many advisors struggle to get their clients' attention—or that their requests to meet and plan for retirement (which could be decades away) go ignored.

But if advisors can engage with clients in ways that reduce their stress, they can get those clients—regardless of what generation they're part of—to listen and take action.

Getting through to stressed clients

Advisors can break through the noise and help clients focus on their financial futures by taking six key actions.

1. Make each interaction short and digestible. Anxious clients may be more receptive to small bites of information. Consider scheduling short meetings or walking them through simple activities that can guide them through your planning process inch by inch. They'll be less likely to feel overwhelmed and more likely to come back to you for advice and solutions.

2. Help clients feel smarter. When clients feel smart and empowered about their financial options, they feel less stress and are more willing to engage. Highlight the benefits of various retirement strategies and solutions, and show them how they can exert some control over outcomes (e.g., by investing regularly or steadily increasing contributions to their retirement plans).

3. Keep it easy. Clients increasingly expect services to be quick and easy. Rather than sticking with processes that add friction to their lives, look for ways to make communications and tasks as straightforward as possible.

4. Reassure clients about their choices and decisions. A quick example that helps clients see how others have dealt with similar challenges can help reassure them that they're making the right decision.

5. Personalize the client experience. Retirement planning itself may not get clients excited, but a personal touch can grab their attention. Some ideas: Swap out financial publications in the waiting room with lifestyle content that speaks to clients' retirement goals; use empowering language when discussing investing and the client experience (e.g., a "discovery session" instead of an initial client meeting). For some clients, gamification may be motivational. For example, you can use an app that allows clients to chart their progress and earn stars or points.

6. Be relevant to the present and to the possible future. Frame retirement-planning discussions around specific issues and stressors that clients are dealing with in their daily lives. If a middle-aged client is taking care of elderly parents, for example, use that to jump-start a discussion about the client's own long-term-care planning.

More than money

Modern life is stressful. Having a trusted advisor and a financial plan can help reduce some of that stress, but first clients need to engage in the process. These tips can help your clients open up and begin making important decisions without shutting down. With you as their guide, they'll have the peace and confidence they need to take control of their financial lives.

What you can do next

- Schwab Alliance provides an easy, secure, and convenient way for your clients to access their account information. Learn how Schwab Alliance can make it easier for clients to take care of business.

- If you don't yet work with Schwab, consider a custodian that is invested in your success. Contact us to learn more about the potential benefits of a custodial relationship with Schwab.

1 "Stress in America 2022," American Psychological Association, https://www.apa.org/news/press/releases/stress/2022/concerned-future-inflation.