Talent, tech, client-centric innovation: Shaping the next era for RIAs

Takeaways from the 2025 Independent Advisor Outlook Study

Key Points

-

- More than ever, RIAs are client champions and business builders, showing that client advocacy and growth go hand in hand.

-

- Advisors are taking a balanced approach to AI, using it to decrease busy work and improve efficiency so that they can focus on client relationships and firm growth.

-

- A hybrid approach to technology—combining a core integrated system with select best-of-breed tools—and increased tech savviness are helping firms scale to meet the growing needs of clients.

When independent registered investment advisors (RIAs) cut from the pack to chart their own course, they started a movement that continues to change the way advisors serve clients. Cerulli projects that by 2028, independent RIAs will represent the strongest growth among all advisor channels—growing 4% per year to reach an estimated 56,000 advisors.1

But this tremendous growth is no accident. As Schwab's 2025 Independent Advisor Outlook Study (IAOS) shows, RIA firms are bringing more to the table than financial advice. In a rapidly changing world, they're leaning into a leadership mentality, bringing visionary thinking, emotional intelligence, and tech savviness to better meet the needs of their clients.

"Independence is not just a business model—it's a mindset," says Jon Beatty, Head of Schwab Advisor Services. "RIAs are proving this every day as they chart a confident path forward—keeping client trust at the center, embracing innovation, and scaling their firms with purpose to deliver stronger outcomes for both clients and their businesses."

Client advocacy and growth go hand in hand

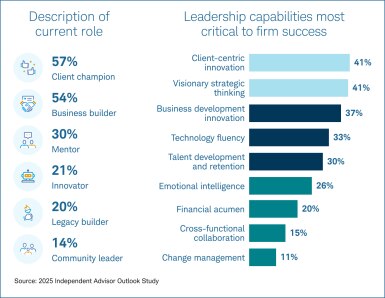

Client champions. Business builders. These are how more than 50% of RIAs see themselves.2 Fueled by an entrepreneurial spirit, these advisors believe that client advocacy and firm growth work together, and see client-centric innovation and visionary thinking as critical to their success.

Another strong focus for RIAs? Building talented teams that grow together, and in turn, helping grow the firm in the process.

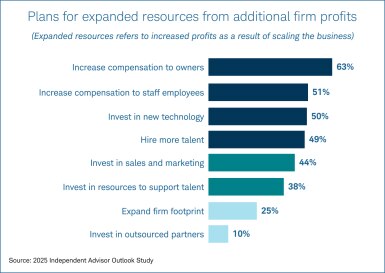

Nearly three-quarters of firms plan to reinvest in their people over the next three years. They're not only sharing profits to reward hard work, they're building cultures that prioritize deepening client trust and delivering value—rather than simply chasing volume. That's why we're seeing a greater focus on AUM per household and client referrals as key measures of firm growth.

A balanced approach to AI

Everyone's buzzing about AI. Is it hype? The backbone of a transformational wave of innovation? Many RIAs believe the answer is somewhere in the middle.

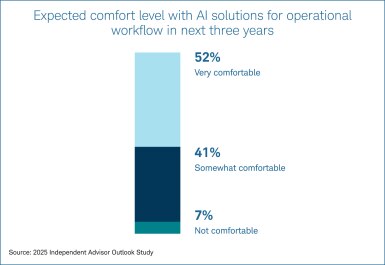

RIAs have been experimenting with AI for a while, but now they're applying it to simplify cumbersome tasks and streamline their workdays. In the next three years, 93% of advisors say they'll be at least somewhat comfortable using AI for operational workflow.

"Advisors are embracing AI with intention—and with every new policy, pilot, and use case, they're moving it from the sidelines to the center," says Jon Beatty, Head of Schwab Advisor Services.

By using AI as a tool for working more efficiently, they're reducing busy work and doubling down on investments in their clients.

"We're seeing advisors start where it matters most—in the day-to-day. AI is helping with essential tasks like notetaking, research, and even drafting documents, saving time and creating space for deeper client work," says Lisa Salvi, Head of Business Consulting and Education at Schwab Advisor Services.

Scaling innovation

Many RIA firms are focused on scaling to achieve growth, making technology upgrades, and embracing new tools. They see the profit potential in integrated systems, automating back-office tasks, and outsourcing functions where their firm doesn't have the level of expertise an outside partner can offer.

In fact, more firms are taking a hybrid approach to technology and operations, putting together a tech stack and partnerships that draw on some of the best of the industry while maintaining strategic integrations that help them stay efficient. By balancing complexity and practicality, RIAs are showing that true independence means they can build the infrastructure their firm needs rather than working around systems that fall short.

"The best tech stacks aren't one-size-fits-all," says Alison Dooher, Head of Wealth Services at Schwab Advisor Services. "They're hybrid; stable at the core, flexible at the edges, and built to evolve as client expectations and firm strategies change."

Rising with intention

A common thread across the 2025 IAOS? Intentional leadership. Early RIAs were scrappy, building an industry from scratch with the help of custodians like Schwab. Today's firms have an opportunity to apply hard-won best practices and innovation to choose their path and aim to accelerate their growth. They're building higher and continuing to drive even more transformation in financial services because they believe there's still more they can do for clients—and now there's even more tools at their disposal to help them do just that.

"Firms need talent and teams that dynamically combine innovation with emotional intelligence," says Beatty. "In our relationship-based industry, sustainable growth will be driven by those who lead with both strategy and heart."

What you can do next

- Dive deeper into the 2025 Independent Advisor Outlook Study results to learn more about this ever-evolving industry.

- Looking to fuel your next move? Whether you're a current client or checking out Schwab, explore how the Schwab Advisor ProDirect™ fee-based membership program can help you reach your goals.

- Curious about how Schwab helps RIAs? Wealth services, technology, and business support are just the beginning. Whether you're exploring independence or considering a custodian swap, we're here to help you take your next step.

1. Cerulli: Independent RIAs to Outpace All Other Channels by 2028, WealthManagement.com, February 13, 2025.

2. Schwab Advisor Services Independent Advisor Outlook Study, September 2025

Schwab Advisor ProDirect™ is a fee-based membership program, and members are subject to the terms and conditions of the Schwab Advisor ProDirect™ Member Agreement.

This report was produced by Charles Schwab & Co., Inc. and is intended for independent investment advisory firms. The report is intended for informational and educational purposes only, and is not intended to provide financial, investment, regulatory, compliance, legal, or tax advice. Any guidance taken from the report is not tailored to the particular circumstances of any reader of the report or their firm.

The report relies, in part, on information provided to Schwab by the advisory firms named and others that participated in Schwab’s research and interviews. Schwab did not independently verify that information, and Schwab makes no representations about the accuracy of the information in the report. In addition, the experience and practices discussed in the report may not be representative of other firms or the experience or results you might obtain.