michael.pendergrass

Acronym

YieldX, Inc.

Product ID

YieldX

Logo

Description

B2B platform opening up fixed income investing to all investors.

Images

Image

Details

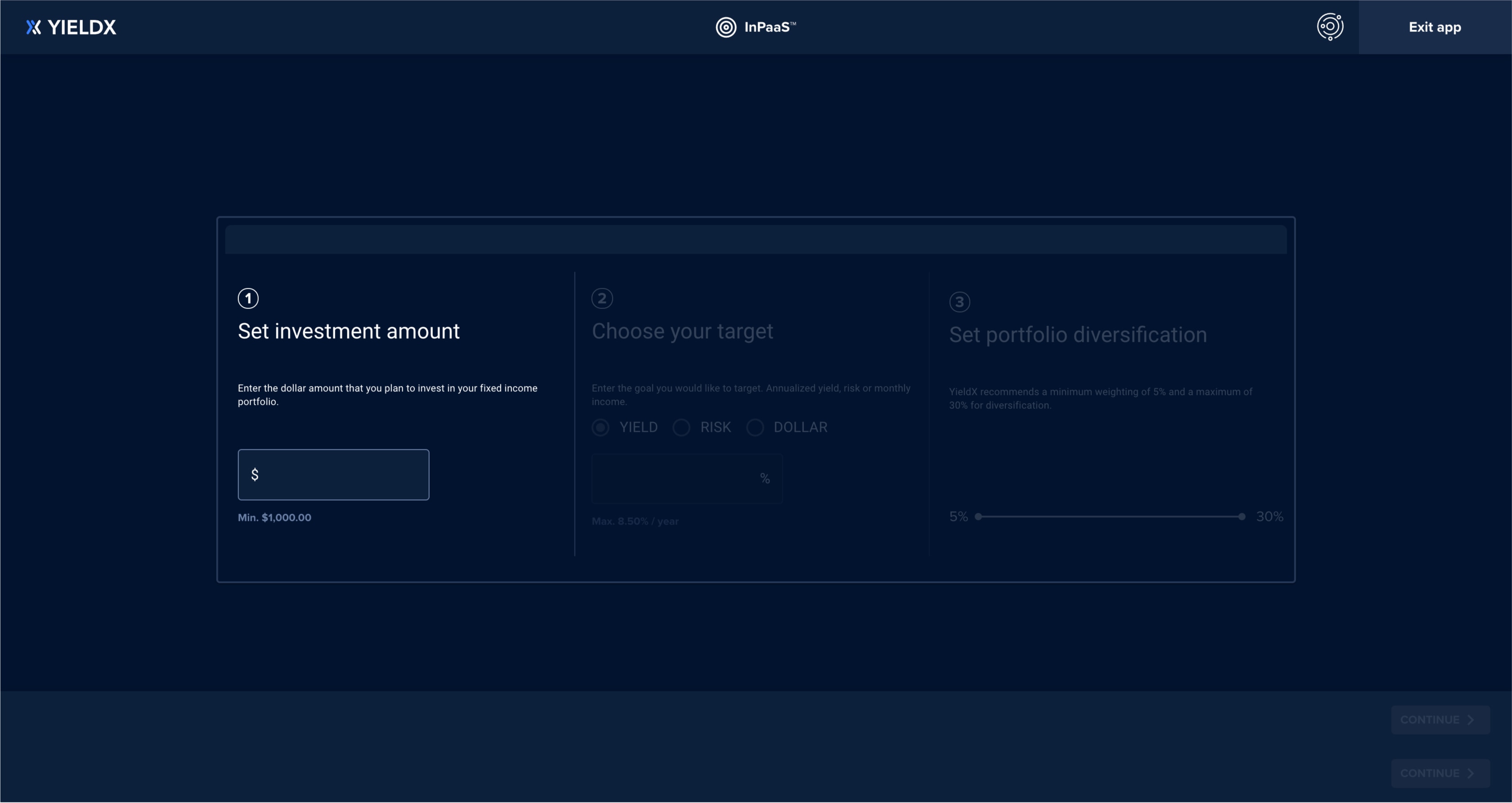

- With 3 simple user inputs, deploy powerful optimization algorithms to analyze and filter a universe of more than 650 fixed income ETFs and CEFs that manage over $1.255 trillion in assets.

- Dynamically construct a portfolio that achieves the desired yield while minimizing risk and expense ratios.

- InPaaS is available within the YieldX platform, accessible via API, or can be embedded into your existing tech stack.

Image

Details

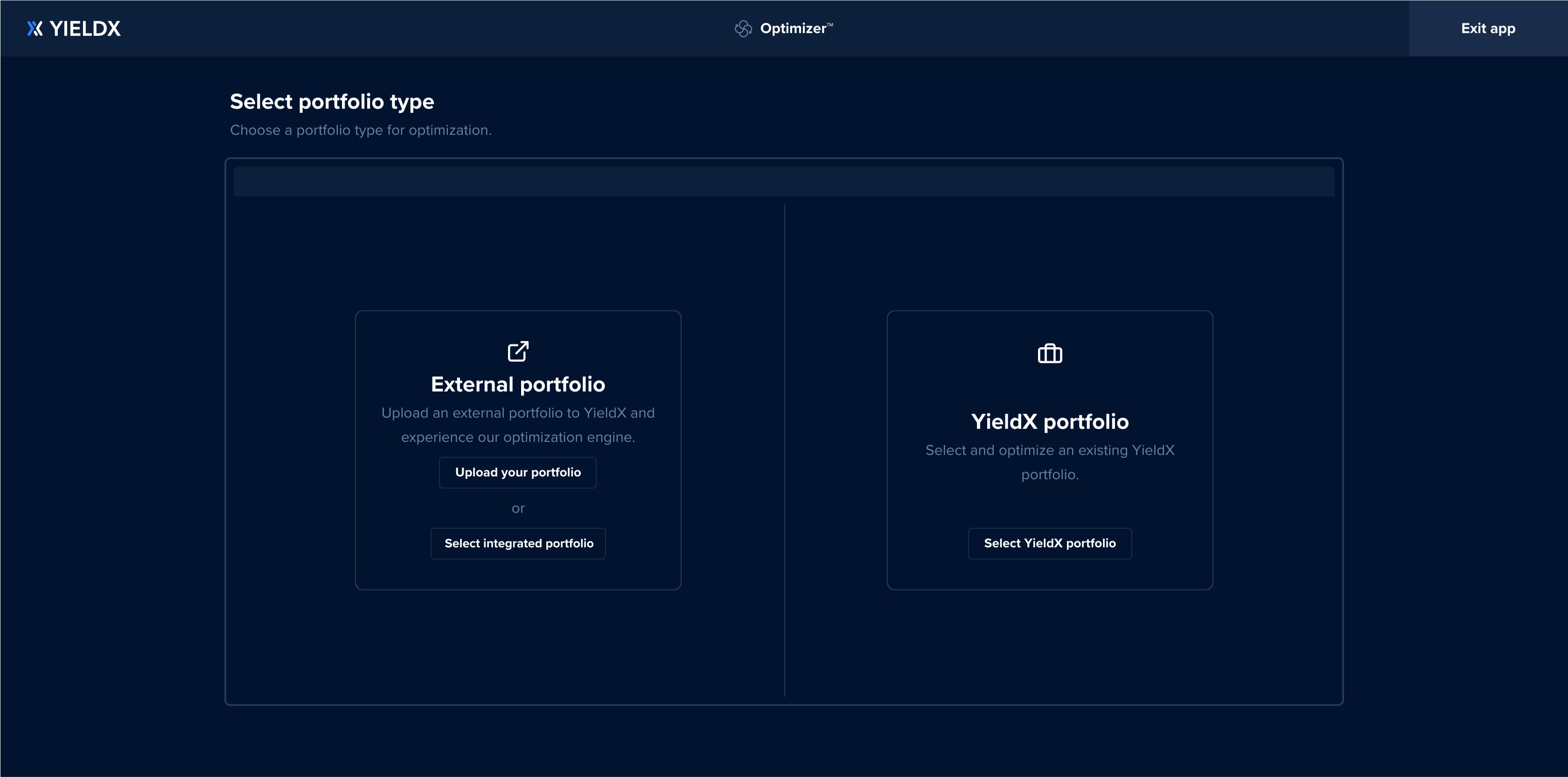

- YieldXs Optimizer solution deploys optimization algorithms to identify opportunities within existing fixed income portfolios to improve the portfolio's overall yield or reduce the portfolio's volatility.

- With YieldX, optimize your portfolio with actionable trade enhancements

- Optimizer is available within the YieldX platform, accessible via API, or can be embedded into your existing tech stack.

Image

Details

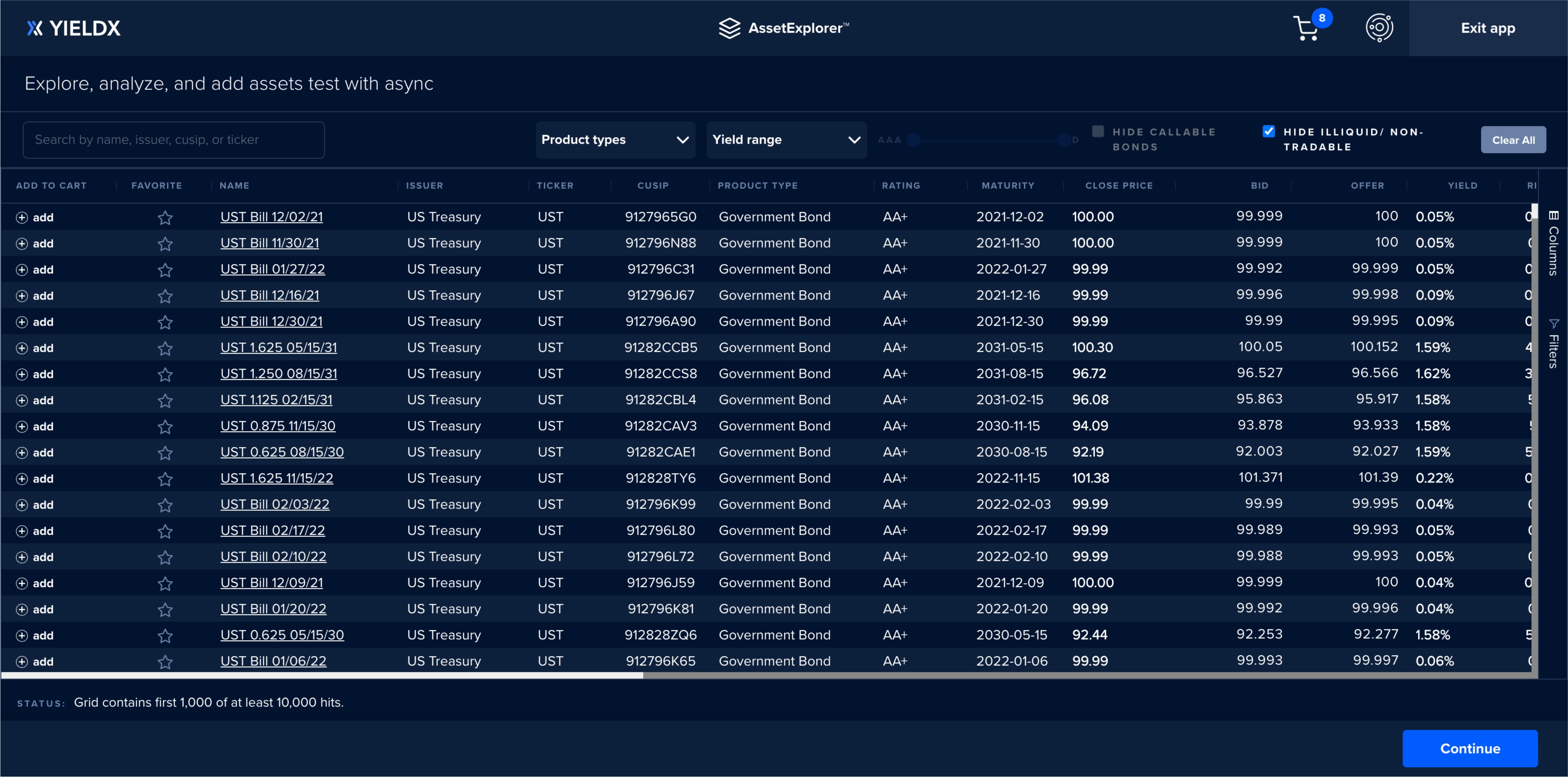

- Access real time indicative pricing, customizable filters, monitoring and portfolio allocation solutions across corporate, municipal, and government bonds, fixed income ETFs, closed end funds, preferreds, and mutual funds.

- For investors and wealth managers who wish to enhance and simplify the process of finding yield, AssetExplorer offers a unique search experience.

- AssetExplorer is available within the YieldX platform, accessible via API, or can be embedded into your existing tech stack.

Features

B2B platform opening up fixed income investing to all investors:

- InPaaS: Target a specific yield, risk or dollar distribution

- Optimizer: Optimize your portfolio with actionable trade enhancements

- Asset Explorer: Search, filter, and sort through 2 million yield driven securities

- Best Fit: Build personalized corporate bond portfolios

- Ladder Builder: Create a bond ladder portfolio in seconds

Vendors

Management Style

Schwab Products

Section