Product infographic carousel

Product infographic images

Product Infographic captions

-

1

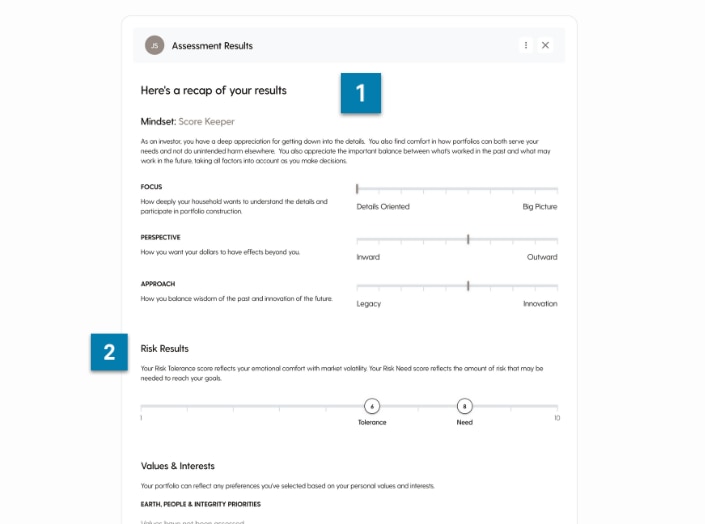

After completing the dynamic assessment, advisors are presented with a recap of their clients' results, explaining their unique investor mindset, preferences, values, interests, risk tolerance, risk need, and more.

-

2

Advisors can capture risk preferences for each client within a household. Seeds measures risk tolerance (emotional capacity for risk) and risk need (the risk a client should assume to achieve their financial goals) to empower advisors to have intelligent and informed conversations about trade-offs.

-

1

In portfolio view, the system has automatically constructed a household level allocation that brings to life the information you gathered through the assessment.

-

2

Add legacy holdings to each account to compare portfolio differences, including risk target and asset class diversification.

-

3

Show prospects how you've tax optimized the location of assets across account types with the current versus target comparison at the account level.

-

1

Make adjustments to asset allocations by adding or removing sleeves as needed, leveraging direct indexing capabilities across equities, or using your own customized models.

-

2

Add specific thematic exposures or thematic based exclusions based on the information your client provided during the assessment.

Product Description

About this Product

Powerful software that makes personalized investing radically simple:

- Access an intelligent, white-labeled assessment framework that empowers deeper client understanding

- Translate assessment results into personalized portfolio proposals

- Implement portfolios and manage trades, tax transitions, TLH, cash raises, rebalancing and more automatically

About Seeds

Founded by financial advisors who recognized the disconnect between clients' financial plans, personal values, and portfolio construction, Seeds helps advisors streamline investment planning and deliver more human, meaningful advice without more busywork. Our assessment is designed to help advisors uncover clients’ full story so you can make recommendations that align with what truly matters to them. On the investment operations side, Seeds automatically handles rebalancing, cash raises, tax transitions, direct indexing, custom UMAs, and more while allowing you to oversee as much of the process as you want. By combining smart automation with personal connection, Seeds simplifies onboarding and investing, reveals better client insights, and handles the operational heavy lifting—so advisors can scale faster and spend more time where it matters most.

Product Details

Contact Us

More info about us

0719-93C0

API integration is available through Schwab OpenView Gateway®, which is provided by Performance Technologies, Inc. (“PTI”). Single sign-on is provided by PTI. Daily data files and trading integration are available through Charles Schwab & Co., Inc. ("CS&Co"), a registered broker-dealer and member SIPC. Not all third party providers listed on this site have integration agreements with Schwab. Schwab OpenView Gateway® is a service of PTI.

References to third parties on this site (whether such parties are vendors participating in a service of PTI or independent advisors using a service of a participating vendor) are not an endorsement or recommendation of, or an opinion (favorable or unfavorable), or advice about, or a referral to any product or service of any third party. Advisors are solely responsible for evaluating, selecting, and purchasing products and services offered by third party vendors. Unless indicated otherwise, third parties are independent and not affiliated with PTI or its affiliates.

Schwab Advisor Services includes the custody, trading, and support services of Charles Schwab & Co., Inc. ("CS&Co"), a registered broker-dealer and member SIPC, and the technology products and services of PTI. PTI and CS&Co are separate companies affiliated as subsidiaries of The Charles Schwab Corporation, but their products and services are independent of each other. PTI’s integration solutions integrate data about accounts custodied at CS&Co.

Access to Electronic Services may be limited or unavailable during periods of peak demand, market volatility, systems upgrade, maintenance, or for other reasons.