Product infographic carousel

Product infographic images

Product Infographic captions

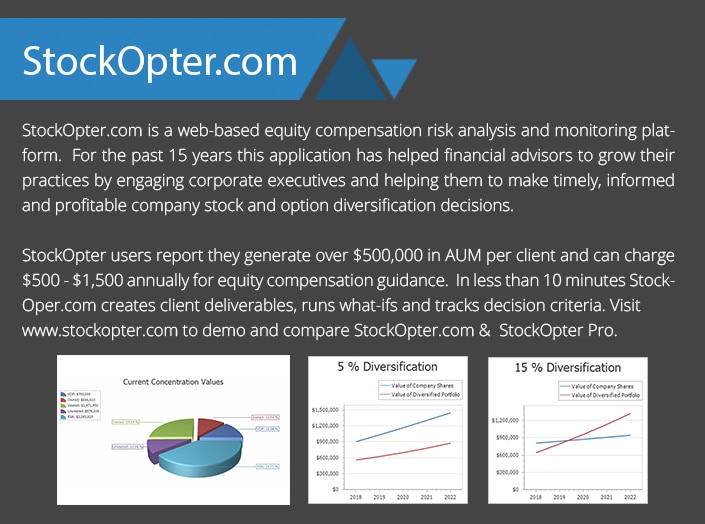

Product Description

About this Product

Equity compensation risk analysis & diversification criteria monitoring:

- Enables advisors to attract HNW clients, AUM & planning fees

- Unlike other planning tools it identifies when & why to diversify

- Quantifies & monitors employer stock/option holdings risk

About Net Worth Strategies Inc

Incorporated in 1999, Net Worth Strategies is the industry leader in professional equity compensation risk analysis and tax planning tools. We provide web-based (StockOpter.com) and desktop (StockOpter Pro) applications that enable financial advisors to grow their practices by engaging and assisting individuals that receive company stock and options to diversify these holdings. On average, advisors that use StockOpter report that they generate $500,000 in AUM per client and can charge between $500-$2,500 annually for equity compensation guidance and tax planning. StockOpter-based guidance helps clients maximize the value of their employee stock options, restricted/performance shares and company stock holdings by providing unique information that facilitates timely, informed and tax efficient diversification decisions. For more information visit: www.stockopter.com.

Other Products from Net Worth Strategies Inc

Product Details

Contact Us

More info about us

0719-93C0

API integration is available through Schwab OpenView Gateway®, which is provided by Performance Technologies, Inc. (“PTI”). Single sign-on is provided by PTI. Daily data files and trading integration are available through Charles Schwab & Co., Inc. ("CS&Co"), a registered broker-dealer and member SIPC. Not all third party providers listed on this site have integration agreements with Schwab. Schwab OpenView Gateway® is a service of PTI.

References to third parties on this site (whether such parties are vendors participating in a service of PTI or independent advisors using a service of a participating vendor) are not an endorsement or recommendation of, or an opinion (favorable or unfavorable), or advice about, or a referral to any product or service of any third party. Advisors are solely responsible for evaluating, selecting, and purchasing products and services offered by third party vendors. Unless indicated otherwise, third parties are independent and not affiliated with PTI or its affiliates.

Schwab Advisor Services includes the custody, trading, and support services of Charles Schwab & Co., Inc. ("CS&Co"), a registered broker-dealer and member SIPC, and the technology products and services of PTI. PTI and CS&Co are separate companies affiliated as subsidiaries of The Charles Schwab Corporation, but their products and services are independent of each other. PTI’s integration solutions integrate data about accounts custodied at CS&Co.

Access to Electronic Services may be limited or unavailable during periods of peak demand, market volatility, systems upgrade, maintenance, or for other reasons.