Schwab Market Update

Trade in Driver's Seat, Hurting Stocks and Dollar

Published as of: June 2, 2025, 9:16 a.m. ET

Listen to this article

| The markets | Last price | Change | % change |

|---|---|---|---|

| S&P 500® index |

5,911.69 |

-0.48 |

-0.01% |

| Dow Jones Industrial Average® |

42,270.07 |

+54.34 |

+0.13% |

| Nasdaq Composite® |

19,113.77 |

-62.11 |

-0.32% |

| 10-year Treasury yield |

4.43% |

+0.01 |

-- |

| U.S. Dollar Index |

98.76 |

-0.57 |

-0.57% |

| Cboe Volatility Index® |

19.68 |

+1.11 |

+5.98% |

| WTI Crude Oil |

$63.63 |

+2.84 |

+4.67% |

| Bitcoin |

$104,535 |

-$525 |

-0.01% |

(Monday market open) Trade could ultimately take a back seat this week to jobs data, but don't count tariffs out as the new month starts. Stocks, Treasuries, and the dollar sank early Monday after a weekend stuffed with trade news, including the promise of higher steel and aluminum tariffs, more tension with China, and the Trump administration vowing there'd be no extension of a 90-day tariff pause due to expire next month. China hit back early today, blaming the U.S. for violating the recent trade agreement after the White House accused China of violating it Friday.

Though major indexes have stalled a bit near recent highs after a strong May, a "buy the dip" mentality persists on Wall Street and may get tested today as tariff talk toughens. "With retail traders, there's still a bias toward the growth trio of consumer discretionary, communication services, and info tech, along with the Magnificent Seven and the AI theme," said Liz Ann Sonders, chief investment strategist at Schwab, speaking on CNBC last Friday. "That's not disappearing in the near term."

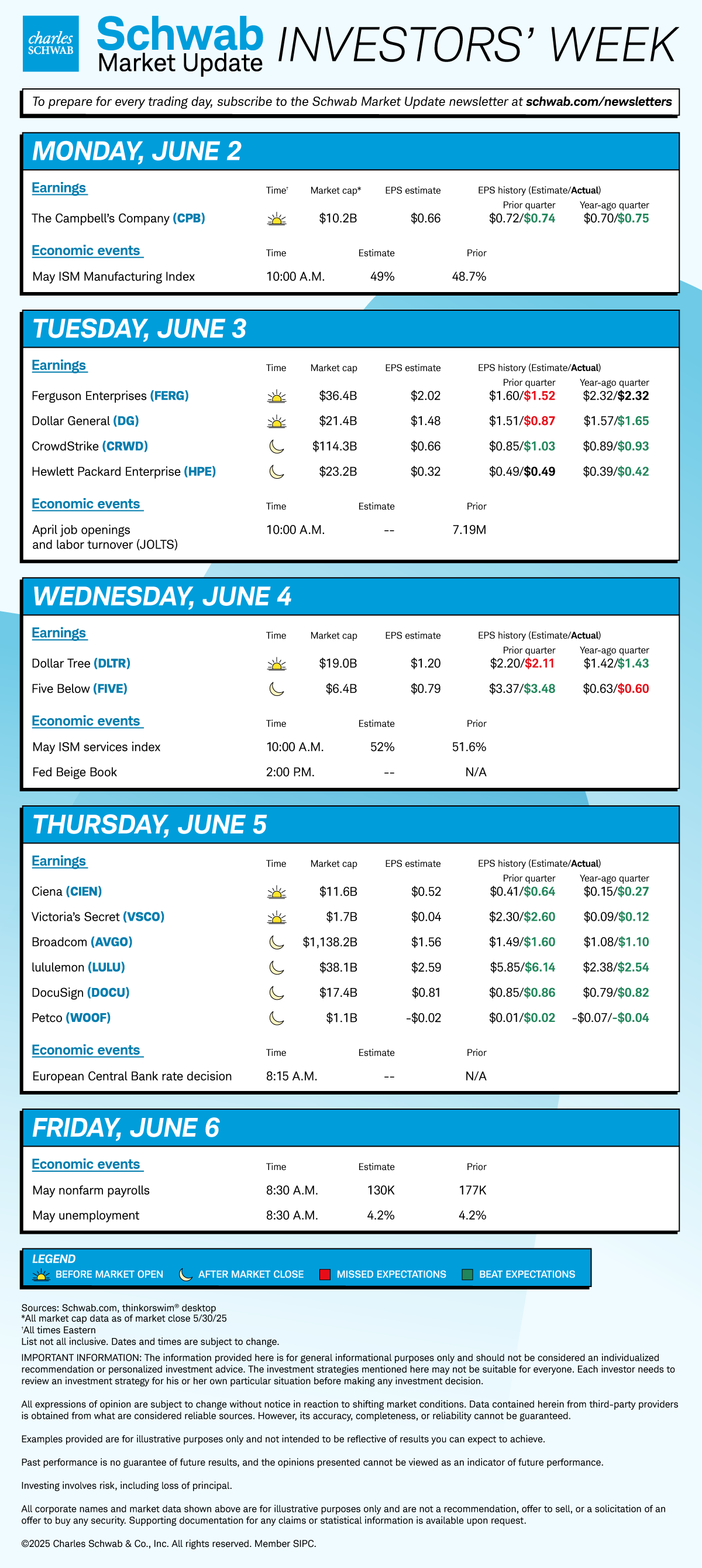

After hearing Federal Reserve Governor Christopher Waller say Monday he's still open to rate cuts this year but warn that tariffs could be "the largest factor driving inflation," investors brace for remarks at 1 p.m. ET from Fed Chairman Jerome Powell. It's unclear if he'll discuss the economy, as he's simply introducing an event. Last Friday's inflation data was benign, but the full impact of tariffs likely hasn't arrived. Job numbers dominate this week, building up to a keystone May nonfarm payrolls report Friday expected to show jobs growth of 130,000, down from April's 177,000. It's quieter on the earnings front, but there are a few names to watch: CrowdStrike (CRWD) reports tomorrow, while lululemon (LULU) and Broadcom (AVGO) report Thursday.

To get the Schwab Market Update in your inbox every morning, subscribe on Schwab.com.

Three things to watch

- Labor data provide fresh look at "hard" numbers: Heading into a packed week of data that includes job openings, layoffs, unemployment, and nonfarm payrolls, recent numbers haven't indicated massive weakness that might get the Fed worried. Last week's slight gain in initial jobless claims was an exception, but one week is a snapshot. "The whole notion of 'labor hoarding' is still valid," Schwab's Sonders told CNBC, referring to a trend where companies are reluctant to reduce labor forces after scrambling to rehire workers after the pandemic. "What we've seen so far is a big compression in hiring but not a big expansion in firing. Claims are the leading indicator to watch. I don't know if this pop in initial claims and continuing claims translates into some sort of really negative print in the jobs report, but that's what to be on guard for. The question is do we see any cracks in hard data following recent weakness in soft data?" The test for hard data is this week's jobs numbers, but before that investors brace for today's 10 a.m. ET May ISM Manufacturing Index. Analysts see the May headline at 49.0, below the 50 needed for expansion and a tad above April's headline. Prices paid will get a close look, too. Despite recent solid U.S. data, the dollar retreated this morning to near its April lows amid renewed trade tension. That would normally be good news for U.S. firms with major markets overseas, but the trade battle complicates their outlook.

- Trump administration eyes options as legal deadline looms: The Supreme Court may ultimately decide if President Trump's "reciprocal" tariffs are constitutional. If not, the Trump administration is likely to come up with other means to increase tariffs, "although they may be less arbitrary, limited in size and scope, or may take time to implement," said Schwab's Chief Global Investment Strategist Jeffrey Kleintop and Michelle Gibley, director of international research at the Schwab Center for Financial Research. The litigation process could take several weeks. One option the administration could use if it loses is to impose 10% to 15% universal tariffs using a different section of law, but for no more than 150 days. The first court deadline looms this Thursday, when The U.S. Court of International Trade—which ruled the tariffs unconstitutional last week—must respond to the Trump administration's appeal that allowed tariffs to stay on the books. In what sounded like a positive trade development, Treasury Secretary Scott Bessent said Sunday that he expects Trump and Chinese President Xi to talk "very soon" and that their recent feud over alleged violations "will be ironed out," Bloomberg reported.

- Court battle could hurt trade deal hopes: Though last week's court ruling against tariffs initially cheered investors, judging from the market's rally on the news, it began a new and more complex phase of the trade war. "Trade negotiations likely will become more difficult and there may be less urgency for countries to cut deals now, particularly for those with less exposure to targeted sectors," Schwab's Kleintop and Gibley wrote. "There may be some relief that tariffs may be less arbitrary and reduced in severity or duration, but the next steps are complicated and likely to extend uncertainty for businesses and the economic outlook." As this plays out, renewed market volatility is possible, and the job stays tough for companies and the Fed as they to assess the impact of tariffs on their businesses and the wider economy. Though stocks and Treasuries wobbled last week on tariff news, "the market reaction toward trade-related headlines has been much more muted recently," versus in April, said Nathan Peterson, director of derivatives analysis at the Schwab Center for Financial Research.

On the move

- Shares of steel maker Cleveland-Cliffs (CLF) rose more than 26% ahead of the open following President Trump's vow to raise steel and aluminum tariffs to 50% from 25%. Nucor (NUE), another steelmaker, rose nearly 11%.

- Tesla (TSLA) dipped 1.6% and Nvidia (NVDA) fell 0.6% in pre-market action as investors mulled geopolitical and trade tensions. Tesla's sales in France fell 67% and Chinese electric car makers enjoyed a strong month in May, posing competition there for Tesla.

- Shares of biopharmaceutical firm Blueprint Medicines (BPMC) jumped 26% early today after French firm Sanofi agreed to buy the immunology-disease specialist for up to $9.5 billion, Barron's reported.

- Bitcoin (/BTC) slid this morning after recently posting all-time highs above $112,000. Last week saw President Trump's company—which operates his Truth Social platform, Trump Media & Technology Group (DJT)—announce plans to raise about $2.5 billion from institutional investors to buy Bitcoin, according to the Wall Street Journal.

- Boeing (BA) rose 1.4% after getting an upgrade to Buy from Bank of America (BAC), which cited recent orders and diminished trade tensions.

- The Campbell's Company (CPB) inched up after earnings results beat analysts' estimates. The company also reaffirmed previous guidance that's in line with consensus views.

- Gold (/GC) climbed more than 2% amid signs of rising geopolitical tension.

- Crude oil (/CL) surged more than 4% early Monday to above $63 per barrel amid rising tensions in the Ukraine-Russia war. The rally came despite OPEC and its allies announcing Saturday that the cartel will raise oil production by 411,000 barrels a day in July. This is to punish countries that over-produce oil and to win market share from U.S. shale drillers, MarketWatch reported.

- As of early Monday, futures trading indicated just a 1% chance of a Fed rate cut in June, and 23% in July, according to the CME FedWatch Tool. The market builds in roughly two rate cuts in 2025, with about 75% odds of the first occurring at the Fed's September meeting.

More insights from Schwab

Next steps in trade war: Last week's whip-saw court decisions on trade revealed how quickly gears can shift in this important matter for the markets. Read about possible next steps in the latest analysis from Schwab's Kleintop and Gibley.

" id="body_disclosure--media_disclosure--215196" >Next steps in trade war: Last week's whip-saw court decisions on trade revealed how quickly gears can shift in this important matter for the markets. Read about possible next steps in the latest analysis from Schwab's Kleintop and Gibley.

Chart of the day

Data source: S&P Dow Jones Indices. Chart source: thinkorswim® platform.

Past performance is no guarantee of future results.

For illustrative purposes only.

The Dow Jones Industrial Average ($DJI-candlesticks) continues to struggle to climb above its 200-day moving average (blue line) near 42,400, finishing last week below that near 42,250. It traded both above and below the 200-day in May but never stayed above it for long or developed much traction when it did exceed that level. A similar trend occurred in March. Meanwhile, the Relative Strength Index, a momentum signal, has retreated slightly to under 55 last week from above 60 in mid-May, a sign of possible weakness.

The week ahead