Looking to the Futures

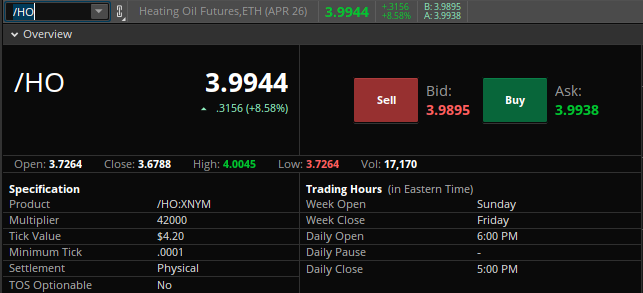

Heating oil futures (/HO) on the rise amidst safety concerns for tankers in the Strait of Hormuz

As conflict escalates between the United States and Iran over the Strait of Hormuz, concerns over the capability to transport products safely via tankers come into the spotlight. U.S. President Donald Trump recently suggested that the U.S. Navy may accompany ships through the strait which provided temporary relief to those monitoring the global supply chain.

Overnight it was reported that a cargo ship was hit by a projectile in the strait which resulted in it being set on fire. This occurred as Iran launched a fresh wave of attacks targeting Israel, Qatar, and the United Arab Emirates.

The International Energy Agency (IEA), which is a Paris-based intergovernmental organization created in the early 1970’s to monitor energy prices over 32 different countries, made comments overnight stating, “the diesel and jet fuel markets are most vulnerable to an extended loss of Middle East supply.” They went on to lower their 2026 global oil demand growth forecast to 640,000 barrels per day as opposed to the previous 850,000 expectation. This announcement came after they ordered the largest release of government oil reserves in history to assist with supply chain bottlenecks by releasing 400m barrels of emergency crude amounting to roughly one-third of their total stockpile.

Heating oil is largely identical to number 2 diesel and is usually dyed red to make a distinguishment between the two products and is refined through a process called fractional distillation. Geographically, the majority of the heating oil consumption from a residential aspect comes from the upper northeast in the United States and Europe.

Last night, Prime Minister of the United Kingdom Keir Starmer pledged that home heating oil costs must be “fair, transparent, and justifiable” amid the crisis in the Middle East. He further reiterated the government will not be tolerable of heating oil suppliers exploiting consumers for profit.

According to the CFTC Commitment of Traders Report published March 3rd, Producers/Merchants/Processors are net-short an overwhelming majority of the open interest against swap dealers. Heating Oil Futures (/HO) are exhibiting backwardation currently with the front month trading lower than the spot price. A reminder that backwardation can be defined as a commodity’s spot (current) price trading higher than the futures price which creates a downward-sloping forward curve.

Futures on the move

Crude Oil Futures (/CLJ26) are up roughly 8% overnight as U.S. intelligence mentioned no immediate risk of a regime collapse which could result in prolonged conflict surrounding the Strait of Hormuz.

CBOE Volatility Index VIX Futures (/VX) are up roughly 7.5% as we saw a slight miss on initial jobless claims (213k versus 215k expected).

Silver Futures (/SI) posted a modest 1.5% gain on the session despite modest procurement from Chinese lead smelters amid price volatility.

What else to watch today

Major economic reports, trading events, and news items that could potentially impact specific futures markets:

Initial Jobless Claims 8:30 AM ET

U.S. Trade Deficit 8:30 AM ET

Housing Starts 8:30 AM ET

Building permits 8:30 AM ET

Federal Reserve Vice Chair for supervision Michelle Bowman speaks about bank supervision at 11:00 AM ET

New Products

New futures products are available to trade with a futures-approved account on all thinkorswim platforms:

- Ripple (/XRP)

- Micro Ripple (/MXP)

- 100 OZ Silver (/SIC)

- 1 OZ Gold (/1OZ)

- Solana (/SOL)

- Micro Solana (/MSL)

Visit the Schwab.com Futures Markets page to explore the wide variety of futures contracts available for trading through Charles Schwab Futures and Forex LLC.