What's Going On…With Inflation

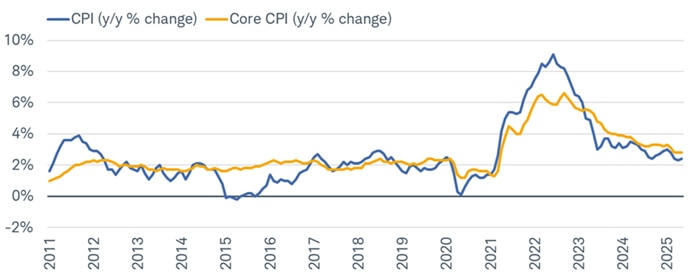

"Complation"…Is there too much complacency regarding inflation? The latest batch of official inflation readings have been fairly benign, begging a question about whether the tariff impact is more bark than bite. As shown below, neither headline nor core (ex-food/energy) consumer price index (CPI) readings were signal flags in May. Core goods prices, which are most directly impacted by tariffs, were flat, meaning the year-over-year (y/y) change was the same as in April; while there are categories putting downward pressure on inflation, including the shelter components and wages.

CPI tame…for now

Source: Charles Schwab, Bloomberg, Bureau of Labor Statistics (BLS), as of 5/31/2025.

The rub is that much of the economic data outside of direct inflation readings suggest higher inflation ahead. Both key purchasing managers indexes (PMIs)—the Institute for Supply Management (ISM) and S&P Global—show that output prices have jumped to levels akin to the early part of the pandemic. The National Federation of Independent Business (NFIB) survey is also showing that a higher-than-average number of small businesses are raising prices, or plan to. Many high-profile larger companies have announced price increases as well—including Walmart, Macy's, Proctor & Gamble, Ford, Subaru, Volvo, Volkswagen, Mitsubishi, Mattel, Adidas, Ralph Lauren, Stanley Black & Decker, Best Buy, Microsoft, and Nintendo.

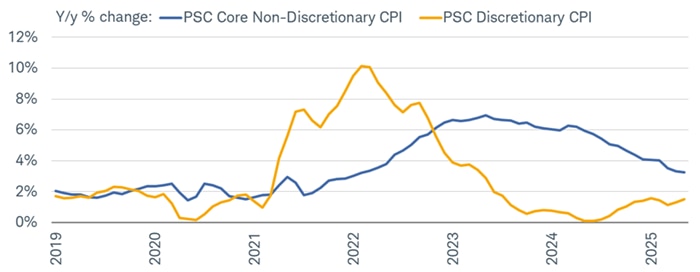

What's also notable is the still-wide gap between the discretionary ("wants") and non-discretionary ("needs") components of the CPI. As shown below, although there has been some convergence between the two, needs' prices are running at about twice the level of wants' prices; disproportionately hurting lower-income consumers.

Needs > wants

Source: Charles Schwab, Piper Sandler & Co. (PSC), as of 5/31/2025.

CPI indexes created by PSC. Core Non-Discretionary categories: Medical Care Commodities, Rent, Hospital Services, Motor Vehicle Maintenance, Motor Vehicle insurance, Motor Vehicle Fees, Day Care and Preschool, Wireless Telephone Services, Internet Services, Personal Care Products, Legal Services, Funeral Expenses, Haircuts & Other Personal Care Services, Financial Services, Pet Services including Veterinary.

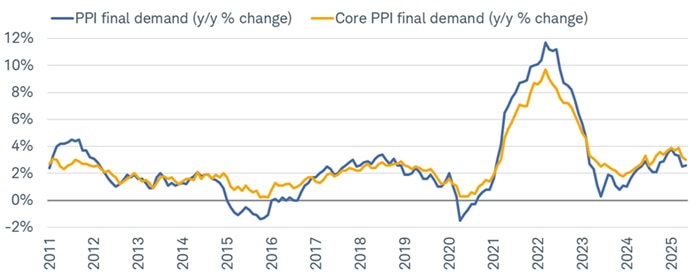

At the producer level, price pressures are still evident but not yet worrisome. Shown below are the y/y and core changes in the producer price index (PPI), which have rolled over slightly but are still in an uptrend since mid-2023.

Warm—not hot—producer prices

Source: Charles Schwab, Bloomberg, Bureau of Labor Statistics (BLS), as of 5/31/2025.

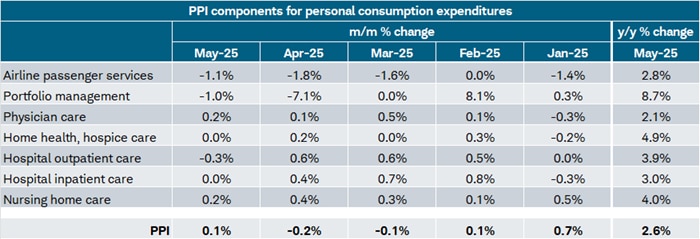

That isn't a red flag by any means, but the PPI is getting outsized attention—particularly in this cycle—because several of its components map over to the Federal Reserve's preferred Personal Consumption Expenditures (PCE) Price Index, giving us a solid idea of what PCE will look like well before it comes out (at the end of each month). As shown in the table below, things are looking good for May's PCE, since the PPI-related components rose by an average of 0.1% month-over-month (m/m).

Source: Charles Schwab, Bloomberg, Bureau of Labor Statistics (BLS), as of 5/31/2025.

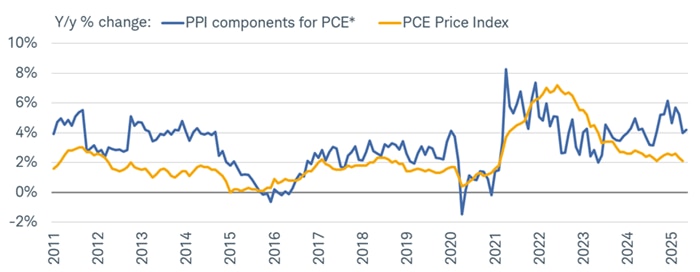

On a y/y basis, however, those components are showing a notable uptrend over the past couple years—an interesting decoupling from the PCE Price Index, as shown in the chart below. Given the services bias in the aforementioned PPI components, some upside pressure in PCE cannot be ruled out in the back half of the year.

A divergence worth watching

Source: Charles Schwab, Bloomberg, Bureau of Labor Statistics (BLS). PPI as of 5/31/2025; PCE as of 4/30/2025.

*PPI components for personal consumption expenditures (PCE) are airliner passenger services; portfolio management; physician care; home health; hospice care; hospital outpatient care; hospital inpatient care; and nursing home care.

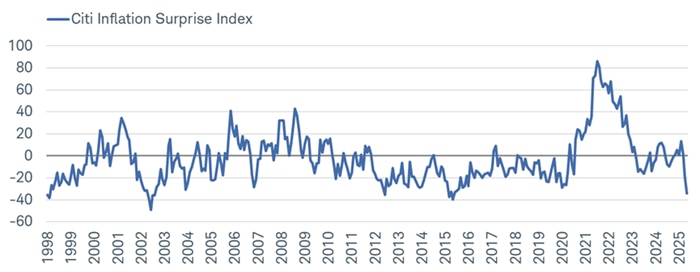

The latest batch of inflation readings has contributed to a significant plunge in the Citi Inflation Surprise Index (measuring how data is coming in relative to consensus expectations). It's also been an aid to the stock market, which tends to perform best when inflation is tracking lower-than-expected. Do notice though that the index oscillates, suggesting less likelihood of any further sustained downward moves—especially given heightened geopolitical tensions and the related surge in oil prices.

Surprise!

Source: Charles Schwab, Bloomberg, as of 5/31/2025.

The Citi Inflation Surprise Indices measure price surprises relative to market expectations. A positive reading means that inflation has been higher than expected and a negative reading that inflation has been lower than expected. Indexes are unmanaged, do not incur management fees, costs and expenses and cannot be invested in directly. Past performance is no guarantee of future results.

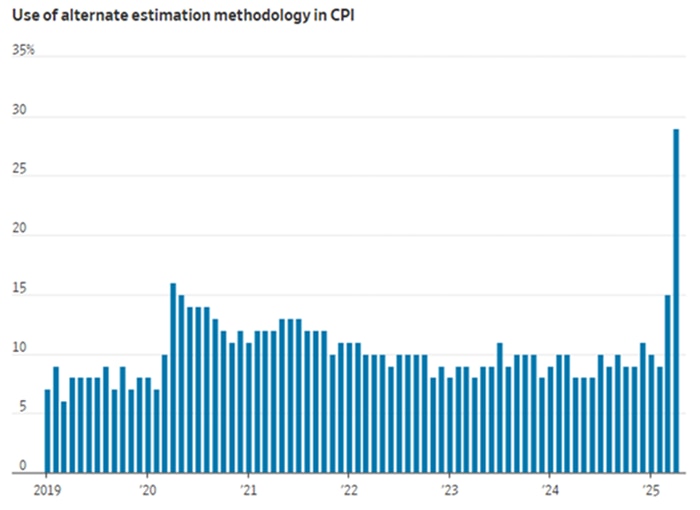

In general, inflation data have become increasingly difficult to analyze and even gather. When the April CPI was released, officials from the Bureau of Labor Statistics (BLS) mentioned that hiring freezes and staffing shortages led to an increased reliance on different-cell imputation—a method that bases price estimates on less comparable products or other regions of the country—much more so than in the past, as shown in the chart below.

Source: Wall Street Journal, UBS, as of 6/4/2025.

Note: Data shows the share of price estimates made with different-cell imputation, a less precise method.

This turns an even brighter spotlight on the issue of layoffs and hiring freezes across government agencies. The BLS also stated that it is no longer collecting consumer price data in: Lincoln, Nebraska; Provo, Utah; and Buffalo, New York. At the headline index level, the changes are likely to be minimal, per the agency; but volatility in month-to-month changes might pick up.

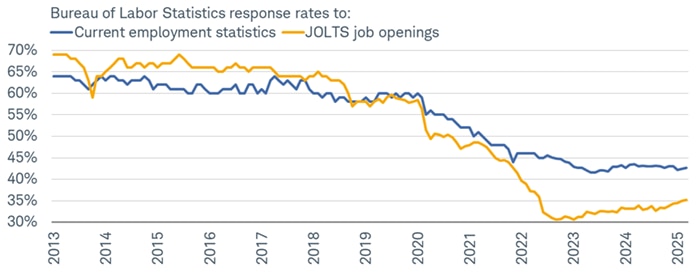

To some extent, more volatility has been "normal" in the post-pandemic world. As shown in the chart below, response rates for key labor surveys—such as nonfarm payrolls ("current employment statistics") and the Job Openings and Labor Turnover Survey (JOLTS)—have barely recovered since the epic drop during the pandemic, helping lead to large revisions in the post-pandemic era.

Responses coming in slowly

Source: Charles Schwab, Bloomberg, Bureau of Labor Statistics, JOLTS (Job Openings and Labor Turnover Survey), as 3/31/2025.

Clearly, the decline in response rates predated DOGE-related layoffs at the federal level, but the recovery likely won't be aided by the fact that agencies continue to face shortages (and perhaps more layoffs down the road). That will likely keep us in an environment of more volatile changes in economic data and larger revisions.

A walk down memory lane

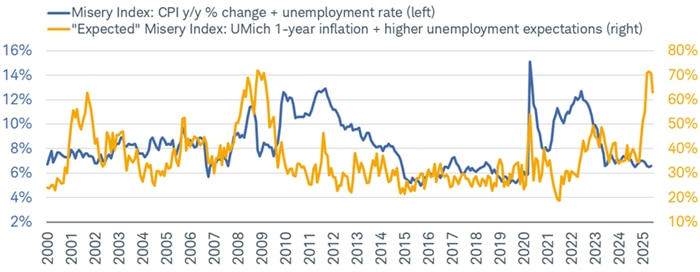

That reality might keep anxiety levels elevated among consumers feeling unstable about the inflation (and employment) backdrop. More "seasoned" readers may recall the Misery Index, created by economist Arthur Okun in the early 1970s. It was meant to capture the level of economic distress felt by the average person by adding the inflation rate to the unemployment rate.

Shown below, the actual Misery Index at present remains contained at less than 7%. But don't tell that to consumers surveyed as part of the Consumer Sentiment Index put out monthly by the University of Michigan. Although off its recent extreme peak, the "expected" Misery Index—which combines one-year inflation expectations with expectations for the change in the unemployment rate—recently spiked to an extreme reading.

Fear > reality

Source: Charles Schwab, Bloomberg, The Leuthold Group, University of Michigan (UMich). Misery Index as of 5/31/2025.

"Expected" Misery Index as of 6/13/2025. Forecasts contained herein are for illustrative purposes only, may be based upon proprietary research and are developed through analysis of historical public data.

In sum

There was a record-breaking surge in imports in the first quarter, as companies and consumers attempted to get ahead of tariff increases. April brought with it a slump in imports—a natural and expected boomerang after the first quarter's surge. But April also brought with it a commensurate surge in tariff revenues, which sends a strong signal of tariff-related inflation yet to come. In addition, although there was a tariff front-running surge in imports in the first quarter, the inventory-to-sales ratio is not running hot, meaning there has not been an excess inventory build.

Assuming the economy continues to expand—and run near-or-above potential—upside inflation risk remains elevated. Adding to the upside risk is, of course, the trajectory of oil prices as it relates to the growing conflict with Iran. These risks could keep the Federal Reserve in its self-imposed "time out" in terms of interest rate policy, barring a significant deterioration in the labor market. Just as complacency can be a peril for stock market investors, it can also lend a false air of "nothing to see here" regarding to inflation ("complation").