The seven questions every advisor must answer on the road to independence

Jon Beatty, Head of Advisor Services, shares insights from our latest study on making the transition to the independent model

Key Points

-

The registered investment advisor (RIA) industry is poised for continued growth, creating new paths and opportunities for advisors drawn to the fiduciary model.

-

Advisors transitioning to independence must make many decisions along the way: What types of clients they want to serve and how, which technology, custodians, and other vendors to partner with, and who they'll lean on for advice.

-

Making the decision to go independent may take some time—but with the right resources and support, advisors can lay the groundwork for a smooth and speedy transition.

An increasingly robust RIA industry, in terms of both firms and the providers that have emerged to support them, means that advisors striking out on their own have more options than ever for making the transition. But more choices also mean advisors must navigate more complex decisions when considering this step in their careers.

In fact, according to our new independence study, a survey we conducted of both recently independent advisors and those considering independence, making those choices can take a good deal of time. Recently independent advisors said they spent between one and three years preparing to make the transition, while 49% of advisors considering independence expect their planning to take about the same amount of time. However, once advisors are ready to make the leap, they move quickly, with recently independent advisors reporting an average transition time of just seven months.

So, how are advisors spending those years of planning and preparation? Our study suggests that they're figuring out the answers to questions that will help shape their business strategy both in the beginning and in the years to come. Here are seven questions that are top of mind:

1. Which path to independence is right for me and my clients?

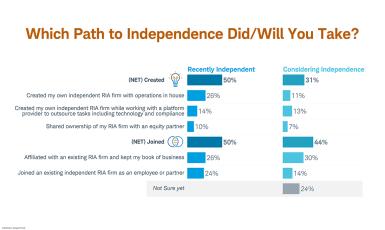

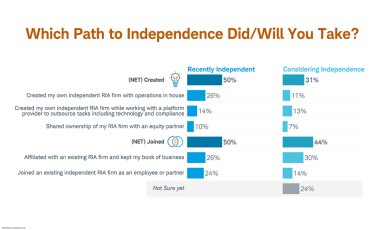

The first question advisors considering independence must think about is the amount of autonomy they want. Are they the type of person who prefers to manage all aspects of the business, would they prefer to focus only on client service, or do they fall somewhere in between? This can help an advisor determine if their ideal path involves starting their own firm or joining an existing RIA—and not only that, but what starting or joining a firm might specifically look like for them.

According to our survey, recently independent advisors are equally as likely to have joined a firm as they were to have started their own, while those considering independence slightly favor joining a firm. Either way, advisors have the flexibility to choose the path that aligns with their desired level of control:

2. What types of clients will I continue to serve?

Successful RIA firms are, at their core, client-centric businesses, so it is critical for any advisor considering independence to understand the types of current clients they want to retain and the types of new clients they want to attract. Identifying the target customer impacts virtually every decision that follows, from how an advisor structures their fees and what services they offer, to what kind of technology they use. In the case of joiners, it can also affect which RIA firms are a fit. Forty-seven percent of all advisors we surveyed cited access to clients who will drive revenue as one of the most important factors for success in becoming an independent advisor.

3. What services do I want to provide?

Advisors in our study are nearly unanimous in their primary motivation for going independent: They want more flexibility when it comes to serving their clients. Almost all advisors (98%) we surveyed cited having the ability to do what is best for their clients as their top reason for pursuing independence. Likewise, 98% also cited the ability to provide more personalized service.

To gain more insight into what that service might look like, we asked advisors about the services they plan to offer (or, in the case of recently independent advisors, the services they already offer):

It's no surprise that advisors are focused on more comprehensive offerings like tax and estate planning. These types of value-add services are one of the key ways we see RIAs differentiating themselves and capitalizing on the growth opportunities afforded by the independent model.

4. What kind of technology do I need to succeed?

Technology is instrumental in how an independent RIA runs their business, and understanding their needs and preferences from the beginning can save many headaches down the line—while also enhancing their ability to serve their clients.

In our one-on-one interviews, advisors repeatedly cited access to a greater variety of capabilities (and the freedom to choose which work best for them) as one of the key benefits of independence. In the quantitative survey, one-third of recently independent advisors and one-fifth of those considering independence said the ability to leverage more cutting-edge technology was the biggest opportunity in becoming an independent advisor.

5. Which custodian(s) do I want to use?

When making the decision to go independent, choosing a custodian is an essential step, not only for their asset custody capabilities, but also for their ancillary services and how they can support an advisor's business goals. Ninety-six percent of advisors (both independent and considering) we polled said custodians play an important role in the transition to independence. Additionally, more than half (57%) of recently independent advisors cited familiarizing themselves with their custodian's platform as a key step they took once they began the move.

The right custodian (or custodians) can be an invaluable resource both before and after the transition to independence, so advisors would do well to spend time carefully evaluating which ones are the best fit for their needs. Custodians can support RIAs through innovative technology solutions, practice management education, networking opportunities, and more. One particular area where advisors indicated they needed transition support and where custodians can provide significant assistance, is regulatory compliance, something 56% of advisors said is the biggest challenge to becoming independent.

6. How do I finance the transition?

Financing the transition to independence is not a small task. About two in five (39%) advisors cited the cost and financing of an RIA firm as the biggest challenge to becoming independent. Moreover, both advisors considering independence and those who recently became independent indicated they were most likely to use their personal savings to finance the move.

However, self-funding isn't the only way to go. Our study found that partnering with an existing firm or taking out a line of credit are also options advisors have pursued or are considering pursuing:

Regardless of the advisor's own financial situation or risk appetite, there are a variety of options for financing the transition, and as the industry matures, it will likely become more and more accessible for advisors to make the jump.

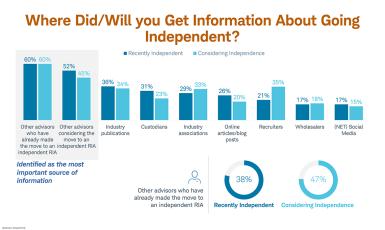

7. Who can I go to for help?

The path to independence needn't be solitary, and according to our survey, advisors in transition are eager for advice and support along the way. Most often, they are turning to each other for guidance, and view their peers as the most helpful source of information. However, advisors have also tapped (or say they will tap) custodians, industry publications, and industry associations for further advice:

Though the journey to independence isn't simple, our study overall suggests that advisors who have made the transition are grateful that they did: 76% said they're happier now as an independent RIA and 69% said they should have made the decision sooner. "You have it drilled into your head almost daily at the wire houses: They are the biggest firms, they are the best firms, and independent RIAs can't compete with them," said a study respondent. "But when you actually step outside that box, you realize, 'Whoa, I can do a lot more here than I ever could at a big firm.'"

About the study

Schwab Advisor Services' study on independence surveyed both advisors considering independence and those who went independent within the past four years about their own experiences exploring and pursuing the independent model. We also spoke to a subset of each group one-on-one for deeper insights. Review the study report.

What you can do next

Learn more about the independent RIA model:

- Explore the core RIA business models.

- Check out Schwab's extensive transition support.

- Dig into Schwab's collection of tools, videos and more.

Take your first steps toward the independent RIA model today. Reach out to a Schwab Business Development Officer to start building your ideal firm. Contact us.

Schwab Advisor Services™ provides custody, trading, and the support services of Charles Schwab & Co., Inc. ("Schwab"), member SIPC, to independent investment advisors and Charles Schwab Investment Management, Inc. ("CSIM"). Independent investment advisors are not owned by, affiliated with, or supervised by Schwab.

This report was produced by Charles Schwab & Co., Inc. and is intended for independent investment advisory firms. The report is intended for informational and educational purposes only, and is not intended to provide financial, investment, regulatory, compliance, legal, or tax advice. Any guidance taken from the report is not tailored to the particular circumstances of any reader of the report or their firm.

The report relies, in part, on information provided to Schwab by the advisory firms named and others that participated in Schwab's research and interviews. Schwab did not independently verify that information, and Schwab makes no representations about the accuracy of the information in the report. In addition, the experience and practices discussed in the report may not be representative of other firms or the experience or results you might obtain.