The RIA Benchmarking Study

Now open: The 2026 RIA Benchmarking Study!

For the past 20 years, the RIA Benchmarking Study has been a trusted resource for thousands of advisors, delivering tailored peer benchmarks and firm-specific insights. By participating in the study, you'll get a clear view of where your firm stands, discover new opportunities, and gain critical knowledge to help strengthen your own business.

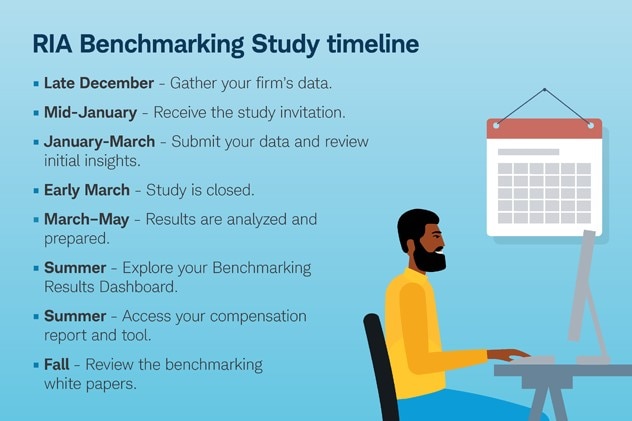

The study closes March 4 at 5:00 p.m. PT/8:00 p.m. ET.

From the archives

The largest study in the registered investment advisor (RIA) industry is also the most respected—with good reason. Take a look back and see what's pushing firms forward.

Data to inform your critical decisions

Why does this firm consider the RIA Benchmarking Study an essential tool for their business? Because "the data points are critical to making good business decisions." Learn how they do it.

“The Benchmarking Study is a requirement in order to keep our business managed in an optimal way and growing as best we can.

”

Ben Dickey and Mike Amash are clients of Schwab and are not compensated for their comments. The experiences described may not be the experience of all clients and is not a guarantee of future performance or success.

About the RIA Benchmarking Study from Charles Schwab

Schwab designed the RIA Benchmarking Study to capture insights in the RIA industry based on survey responses from individual firms. The 2025 study provides information on topics such as asset and revenue growth, sources of new clients, products and pricing, staffing, compensation, marketing, technology, and financial performance. Fielded from January to March 2025, the study contains self-reported data from 1,288 firms that custody their assets with Schwab and represents over $2.4 trillion in assets under management, making this the leading study in the RIA industry. Schwab did not independently verify or validate the self-reported information. Participant firms represent various sizes and business models. The study is part of Schwab Business Consulting and Education, a practice management offering for RIAs. Grounded in the best practices of leading independent advisory firms, Business Consulting and Education provides insight, guidance, tools, and resources to help RIAs strategically manage and grow their firms.

Past performance is not an indicator of future results.