What's New: Move Money

Schwab Advisor Center® has digital tools and resources to help you onboard new relationships, support your clients, and scale your business. Below you can learn about the latest enhancements and resources, or explore recent updates by clicking on a topic.

Overview

Moving money is one of the most important things you do for your clients, and the Schwab Advisor Center move money tool enables you to complete this critical task in the most secure and efficient way possible.

Use these resources to get an overview of the tool; continue scrolling to see the latest enhancements.

- Video of Schwab Advisor Center's move money tool >

- Step-by-step guide to the experience for you and your clients >

- Printable overview of move money features and benefits >

- Quick guide to move money eAuthorization >

- View a live demo: Register for a webcast with our experts >

July 2021 (0621-1XF4)

Explore the latest enhancements in move money

We have added more functionality to the redesigned move money experience to make transacting for clients easier than ever. Look for more enhancements in the coming months, in addition to those that just launched.

Standing authorizations for internal position transfers

You can now use new or existing standing authorizations for internal transfers without requiring approval from your client for each new transaction.

More account registrations compatible with digital checks and internal transfers

You can now use move money to generate checks and internal transfers for the following account types:

- Estate

- Testamentary Trust

- Guardianship1

- Conservatorship1

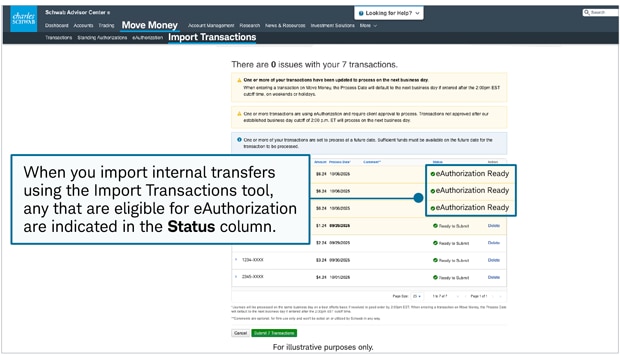

eAuthorization for internal transfers using the import transactions tool

Now you can send internal transfers that you upload via the Import Transactions tool to clients for approval via eAuthorization. This new feature does not require that you modify the CSV file you are currently using to import internal transfers, and the system automatically designates as the approver the first account owner eligible for eAuthorization.

Submit total transfer and account close requests digitally for all account registrations

You can submit these requests as check or internal transfer transactions using a prefilled PDF form and the transaction appears on move money as soon as the signed PDF is received by Schwab.

1 These registrations do not support standing authorizations for checks, journals, and wires.

October 2025 (1025-M3TL)

Major enhancements now available in the redesigned move money experience

As part of our ongoing expansion of the capabilities available in the redesigned move money experience on Schwab Advisor Center, we have added several features designed to make transacting for your clients easier than ever. With these updates—and more in the coming months—we plan to retire the legacy move money in late October.

Enhancements that just launched include:

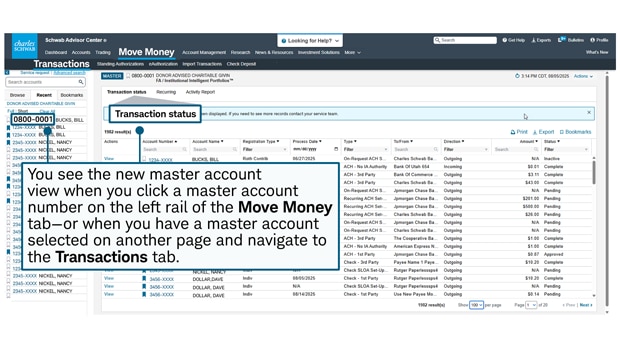

- A redesigned master account view. Now when you click a master account number on the left rail of the Move Money tab, you're taken to the new view on the Transactions tab. If you've already selected a master account on a different page of Schwab Advisor Center, clicking the Move Money tab also brings up that account in context on the Transactions tab. This replaces the master status view subtab in the legacy move money workflow.

- Establishing standing authorizations with the approval of a single client. The following account registrations require only one account holder's approval to establish a new standing authorization when processed through the redesigned move money experience:

- All Tenants by Entirety

- Community Property (and Designated Beneficiary Community Property)

- Joint Tenant (and Designated Beneficiary Joint Tenant)

- Tenants in Common (and Designated Beneficiary Tenants in Common)

- Life Tenancy

- Improved layouts. The review, confirmation, and view pages for ACH, internal cash transfers, and check transactions have been redesigned to display more information on-screen, eliminating white space and unnecessary scrolling.

- Importing Roth IRA conversions. You can use the import transactions tool to upload up to 2,000 internal cash transfers for Roth conversions at once, eliminating the need to enter each one separately. You can combine Roth conversion transfers with other internal transfer types in a single file.

- Access to initiate and release functionality. This optional feature—which requires that a designated user approve each transaction before it is released to Schwab for processing—is now compatible with the redesigned move money experience. If you are interested in adding this feature to your firm's move money workflow, contact your service team.

September 2025 (0925-4STS)

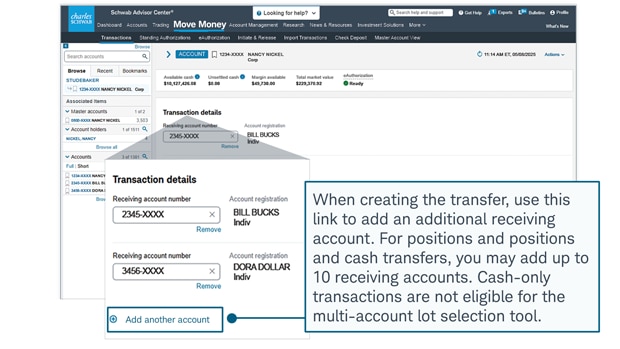

Transfer positions and cash to multiple accounts via a single workflow

Using the redesigned move money tool, you can now transfer positions or positions and cash to multiple accounts in a single workflow, making it easier than ever to transact for your clients.

Benefits of this new functionality

- View and select individual positions/lots for internal transfers to up to 10 Schwab accounts

- Select lots manually or use your preferred cost basis method

- Clients can approve these transfers using fast, secure eAuthorization, or you can use the move money workflow to generate a prefilled authorization form (note that some account registrations are not compatible with the lot selection tool)1

To get started, select Position or Positions and cash as the transfer type, then click the Add another account option.

1. Conservatorship, estate, guardianship, testamentary trust, transfer into i401(k), transfer into Roth i401(k), and custodial account registrations are not supported by the lot selection tool.

July 2025 (0725-FFA6)

Important changes coming to move money: Less risk and more efficiency

To ensure faster processing and more robust fraud protection, Schwab is streamlining our support of move money transactions. In Q3 we will require that digitally eligible move money transactions be submitted through the digital workflows available on Schwab Advisor Center. Docusign requests will also be accepted.

Key dates and what you need to know

Move money transactions that have a digital option available will no longer be accepted via email, phone, or service request after the following time frames.

- Mid-August: Submit move money transactions where your firm has authority through Schwab Advisor Center's digital workflows.

- Mid-October: Submit move money transactions requiring client approval through Schwab Advisor Center's digital workflows.

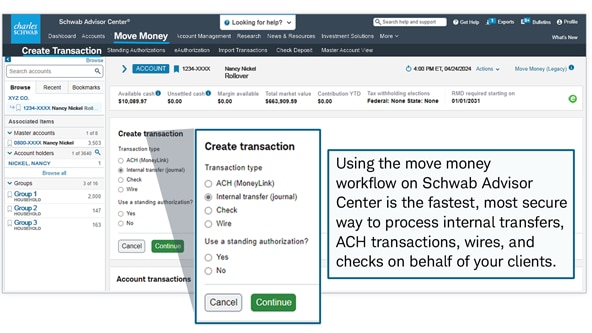

Schwab's move money digital workflows are the fastest, most secure way to process internal transfers, ACH transactions, wires, checks, and other key tasks:

- Processing transactions in bulk with import transactions. Move money allows you to submit hundreds of transactions at once using a preformatted CSV file to upload transaction details.

- Editing tax withholding elections. Move money allows you to set withholding below federal or state minimums, opt out of federal or state withholding, or establish first-time tax withholding elections for the account without leaving the move money workflow.

- Creating recurring internal transfers or ACH transactions for existing profiles. Move money allows you to establish recurring internal cash transfers using a standing authorization, as well as recurring ACH transactions and profiles from on-request profiles where your firm has authority.

- Designating lots when transferring positions between Schwab accounts. Move money allows you to specify individual cost basis lots or apply an alternate cost basis method when requesting an internal position transfer online.

Completing the new move money experience

We're also excited to share that we'll be completing our redesign of the move money experience this year, including adding the final key features such as Master Account View and initiate and release capabilities. Once the new move money design is complete, you'll have a single, modern move money experience to fulfill your clients' money movement requests.

We'll continue to provide more guidance and education, but you can start now with resources such as our interactive guide and weekly expert-led webcasts.

June 2025 (0625-1BPA)

Create and save wire templates without sending a wire

Now you can use the digital move money workflow to create and save a wire template for future use—even if you're not currently sending a wire. This makes it easy to send future wires that use the same details without the need to fill out all the required information each time.

Previously, the system would offer users the opportunity to save a wire as a template after the user had finished sending a wire. This new enhancement makes it easy for one person at your firm to create a template, which other users can then use as needed. Some firms may wish to use this feature for review and approval of all details by a senior staff member before a wire is sent out.

February 2025 (0225-NFPV)

New charitable distribution and transaction activity enhancements to move money

The latest enhancements to the move money tool on Schwab Advisor Center make it easier to make charitable distributions on your clients' behalf—and to see all of an account's transaction activity in a single view.

Qualified charitable distribution enhancement

You can now edit an existing check standing authorization from the Normal-7 distribution code to the QCD-7 charitable code without obtaining your client's authorization so long as the client is over 70½ years old. The QCD-7 code sets the tax withholding for that transaction to zero with no impact on the account-level settings and future-dated or recurring transactions. This enhancement facilitates making distributions to a charity without the need to keep updating the tax withholding election at the account level—all without the need for additional client approval.

New "All" activity view

Based on advisor feedback, we have added the new All tab in the Account Transactions section; it provides at-a-glance information about a wide variety of transactions in a client's account, regardless of a transaction's status. You can still access the dedicated tabs for upcoming, recent, and recurring transactions, but the information on those tabs is now available on the All tab, as well.

December 2024 (1224-8FVL)

The waiting period for new ACH profiles has been removed

Based on your feedback, we have removed the waiting period when you set up a new ACH profile on Schwab Advisor Center. This means you can now request an ACH transfer the same day the profile is approved.

- You can also use the Update or fund an account digital workflow on the Account Management page to establish a new ACH profile.

- Your client can now initiate an ACH transfer through Schwab Alliance on the same day the ACH profile is approved.

- You can track the progress of the ACH profile setup using the Schwab Advisor Center Status tab or the move money tool.

As with all transfer requests you create for your clients, we recommend using our quick, intuitive, error-reducing digital workflows for the fastest, most secure processing.

We continue to improve the move money experience. For example, now you can use your standing authorizations to set up recurring internal transfers through Schwab Advisor Center. We will keep you informed as other new features are added to the tool.

November 2024 (1124-16WF)

Initiate internal transfers for aggregate margin accounts using move money

You can now initiate internal transfers using the move money tool for aggregate margin accounts without contacting your service team—even if the requested amount is greater than the balance in the account. If the aggregate margin balance exceeds the transfer amount, the transfer will be executed. If the aggregate margin balance is sufficient to cover the request, the system will proceed as normal. Margin rates apply.

This new feature executes seamlessly for relevant transfers on compatible accounts, as there are no changes to the user experience or the interface. And just like any other internal cash or position transfer, your clients can digitally approve these internal transfers via fast, secure eAuthorization.

Remember that you must future-date any ACH transfers or check requests that will use the account’s aggregate margin balance.

October 2024 (1024-TDCX)

New tax withholding edit capability and calculator for move money tool

Users with WPFA authority and access to the Update move money security group can now edit a client's tax withholding election (TWE) from the move money account header without creating a new transaction. Advisors can also take advantage of a new calculator in the transaction workflow to enter a dollar amount and automatically calculate the relevant percentage.

Editing TWE*

This new feature lets you set withholding levels below federal or state minimums, opt out of federal or state withholding, or establish first-time tax withholding TWEs for the account—all without the need for additional client approval and without ever leaving the move money tool. Users with the proper permissions will see a new Edit button next to the TWE setting in the Move Money account header.

TWE dollar-to-percentage calculator

The new calculator icon is next to the Federal and State tax input fields in the transaction workflow. Click the icon and enter an amount, and the calculator will automatically translate your dollar figure into a percentage. Your selection will automatically apply to all future transactions and standing authorizations for that account.

*Note that you can still update a TWE if your firm has only LPFA/NDFA authority for an account, using one of the following methods:

- Submit a transaction using the updated TWE.

- Contact your service team and request the update.

- Have your client update the TWE through Schwab Alliance.

Please note that any special withholding requirements for specific states still apply. For more information, consult the Service Guide.

July 2024 (0724-CCZA)

Don't miss out on the latest enhancements to the move money experience

We have been working to refine and expand our capabilities, ensuring that every move money interaction is both intuitive and secure. We have recently rolled out several key features—all designed to make the process of managing and transferring funds as seamless and efficient as possible.

- Use a one-time ACH (Schwab MoneyLink) profile to schedule recurring transactions. This feature enables the scheduling of recurring transactions without requiring client reauthorization for each request. You can also edit tax-withholding amounts for ACH transactions, offering more control.

- Designate lots when transferring positions between Schwab accounts. Now you can view and designate specific lots or apply an alternative cost basis method when requesting an internal position transfer. eAuthorization is also now available for internal position transfers.

- Use the new 7-QCD withholding election code for qualified charitable distributions. This option applies 0% tax withholding without affecting the account-level setting.

- Put funds to work faster and schedule future wires with the move money tool. Inbound ACH flows now feature a new "available to trade" date, clarifying that funds can be used immediately for trading. In addition, you can create and get client approval for wires up to 90 days in advance.

- Upload multiple wire transactions at once and save templates for future wires. In addition to checks, internal transfers, and ACH transactions, you can now quickly and securely submit multiple transactions for different master accounts by uploading a single CVS file. Additionally, you can now save wire transaction details as a template for future transactions.

- Create trust standing authorizations with only one trustee's approval—and easily edit the names of payees for first-party wires and checks. Streamlining the management of trust accounts and transactions is now even easier, allowing for standing authorizations for living trust and testamentary trust accounts with just one trustee's approval, as well as the ability to easily edit payee names for wires and checks.

To get the most out of these updates, please join an upcoming move money webcast to learn how you can use move money to initiate the vast majority of your clients' money movements on Schwab Advisor Center.

May 2024 (0524-ZKVS)

Process qualified charitable distributions with the 7-QCD code for tax elections

You can now choose the 7-QCD distribution reason when initiating checks or standing authorizations for checks. This option sets the tax withholding for that transaction to zero with no impact on the account-level settings and future-dated or recurring transactions.

If any of your standing authorizations with the Normal (7) distribution reason are currently being used for charitable distributions, you can create a new standing authorization using the 7-QCD reason without additional client approval by following these steps:

- Create the new standing authorization with the 7-QCD distribution reason and all other details the same as the existing standing authorization with the Normal (7) reason.

- Opt out of eAuthorization on the Review step and discard the downloadable prefilled PDF.

- Schwab will manually compare your submission with your firm's existing standing authorizations. If the new standing authorization matches an existing one with the Normal (7) reason, Schwab activates the new 7-QCD standing authorization without additional client approval.

May 2024 (0524-ZKVS)

Designate lots when transferring positions between Schwab accounts

Now when transferring positions from one Schwab account to another using the move money tool, you can view and designate specific lots or apply an alternate cost basis method when requesting an internal position transfer.

With this new enhancement, when choosing lots to transfer you can more easily see specific lot information, including:

- Cost basis

- Holding period

- Acquired date

- Cost per lot

There is no change to the client experience. And just like any other internal position transfer, your client can digitally approve those that designate specific lots via fast, secure eAuthorization.

April 2024 (0424-UY7P)

Create trust standing authorizations with only one trustee's approval; easily edit the names of payees for first-party wires or checks

Two new enhancements to the redesigned move money workflow make it even easier to transact on behalf of your clients.

Establish trust standing authorizations with the approval of a single trustee

The move money workflow now lets you establish standing authorizations for living trust and testamentary trust accounts with the approval of a single trustee.

When using this enhancement, your client can digitally approve living trust accounts using eAuthorization, whereas testamentary trust accounts require a signed prefilled one-time authorization PDF form. Please also note that once the standing authorization is established, you cannot generate testamentary trust transactions through the move money tool; as before, these requests should be submitted to your service team.

Easily edit the names of payees when initiating first-party wires or checks

A new field in the move money workflow lets you modify the payee name field when creating a first-party wire or check. This enhancement applies to recurring and one-time transactions, as well as standing authorization setups.

April 2024 (0424-UY7P)

Upload multiple wire transactions at once and save templates for future wires

Two new updates make initiating wires for your clients through the Schwab Advisor Center move money tool even easier.

Import wire transactions

In addition to one-time cash internal transfers, checks, and ACH transactions, you can now upload multiple wire transactions using the move money tool. The feature lets you submit multiple transactions for different master accounts quickly and securely by uploading a single comma-separated values (CSV) spreadsheet file. The tool automatically applies details such as payee and address to each transaction based on data Schwab has on file. Next it validates the transaction data and alerts you to any issues. You can view and export this data via the History page.

For detailed instructions on how to use the import transactions feature and format a CSV file, explore our updated step-by-step move money guide or visit the Service Guide.

Save wire templates

You can now save the details of a wire transaction to reuse as a template for future transactions, as well. These saved templates are not preauthorized by clients and save you the trouble of reentering information each time, avoiding errors and improving efficiency. You can find and manage templates from the account’s Transaction table.

March 2024 (0324-4DNK)

For advisor use only. For general educational purposes.

Any investments reflected are for illustrative purposes only and are not intended to be nor should they be construed as a recommendation to buy, sell, or continue to hold any investment. Screen shots are for illustrative purposes only, may be historical in nature, and should not be used as a basis for any investment decision.

Schwab Advisor Services™ includes the custody, trading, and support services of Charles Schwab & Co., Inc. ("Schwab"), a registered broker-dealer and member SIPC, and the technology products and services of Performance Technologies, Inc. ("PTI"). PTI and Schwab are separate companies affiliated as subsidiaries of The Charles Schwab Corporation, but their products and services are independent of each other. PTI’s integration solutions integrate data about accounts custodied at Schwab.

API integration is available through Schwab OpenView Gateway®, which is provided by PTI. Single sign-on is provided by PTI. Daily data files and trading integration are available through Schwab. Schwab OpenView Gateway® and Schwab OpenView MarketSquare™ are services of PTI.

References to third parties (whether such parties are vendors participating in a service of PTI or independent advisors using a service of a participating vendor) are not an endorsement or recommendation of, or an opinion (favorable or unfavorable), or advice about, or a referral to any product or service of any third party. Advisors are solely responsible for evaluating, selecting, and purchasing products and services offered by third party vendors. Unless indicated otherwise, third parties are independent and not affiliated with PTI or its affiliates.

Schwab Performance Technologies® ("SPT") provides technology solutions to independent investment advisors, while Schwab provides them and their clients with custody, trading, and related support services. SPT and Schwab are separate companies affiliated as subsidiaries of The Charles Schwab Corporation, but their products and services are independent from each other.

Schwab Advisor Portfolio Connect™ is a product of SPT.

Institutional Intelligent Portfolios ("IIP") is a technology and service platform made available by SPT to independent advisors who maintain a business relationship with Schwab Advisor Services.

Charles Schwab & Co., Inc. and Charles Schwab Bank are separate but affiliated companies and subsidiaries of The Charles Schwab Corporation. Brokerage products, including the Schwab One® brokerage account, are offered by Charles Schwab & Co., Inc., Member SIPC. Deposit and lending products are offered by Charles Schwab Bank, Member FDIC and an Equal Housing Lender.

Schwab affiliates earn revenue from the underlying assets in Institutional Intelligent Portfolios® accounts. This revenue comes from managing Schwab ETFs™ or Schwab Funds® and providing services relating to certain third-party funds that can be selected for the portfolio, and from the cash feature on the accounts. Revenue may also be received from the market centers where ETF trade orders are routed for execution. Tax-loss harvesting is available for clients with invested assets of $50,000 or more in their Institutional Intelligent Portfolios account. Clients must be enrolled to receive this service. Cash balances held in the Sweep Program at Schwab Bank are eligible for FDIC insurance up to allowable limits per depositor, per account ownership category.