What's New: Digital Workflows

Schwab Advisor Center® has digital tools and resources to help you onboard new relationships, support your clients, and scale your business. Below you can learn about the latest enhancements and resources, or explore recent updates by clicking on a topic.

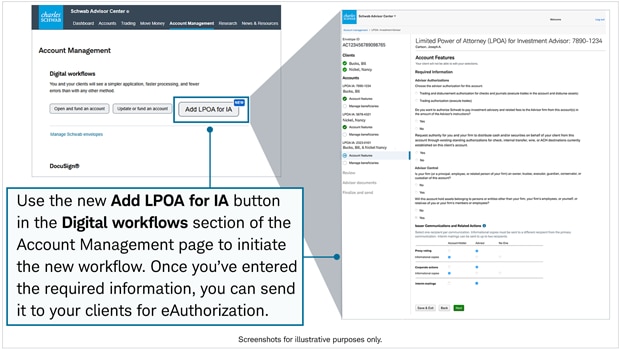

Update your authority level on client accounts digitally

A new digital workflow now allows you to add or modify your firm's authority level on up to 20 of your clients' accounts in a single envelope. Previously, advisors had to use Docusign or a paper LPOA-IA form to make these changes. This feature is particularly helpful when onboarding new clients.

The workflow auto-fills the data for clients who are already registered with your firm's Schwab master account, reducing the potential for errors and rework. Best of all, you can include multiple authority changes in the same digital envelope.

February 2026 (0226-5VF2)

Now add options and margin trading to an existing account—digitally

A new feature makes it easy to add options and margin trading to existing accounts through a streamlined digital workflow.

To start the new workflow, click the Update or fund an account option on the Account Management page, then choose Margin and options trading under the Trading section.

- For existing accounts, you can add or upgrade options (with or without margin) or add margin only (with no options).

- You can enhance existing retirement accounts with support up to Options level 2 (with limited margin), or you can add margin only (with no options).

The workflow is designed to present only relevant choices. If your firm's master account is not approved for a certain options level, for example, that option will not be available, and you'll see a notification box explaining the situation. This helps reduce errors and rework.

Other benefits you'll enjoy when using this workflow:

- You save time and reduce errors using a guided workflow that auto-fills and validates client information from Schwab.

- You can enter key client information, or, if you don't have it, your client can enter the data during the approval process, so you don't spend time chasing down details.

- You can leverage detailed status tracking and can recall, edit, and resend digital envelopes.

For more details, please consult the interactive guide to all of our account management workflows.

July 2024 (0724-CCZA)