What's New: Trading & Investment Management

Schwab Advisor Center® has digital tools and resources to help you onboard new relationships, support your clients, and scale your business. Below you can learn about the latest enhancements and resources, or explore recent updates by clicking on a topic.

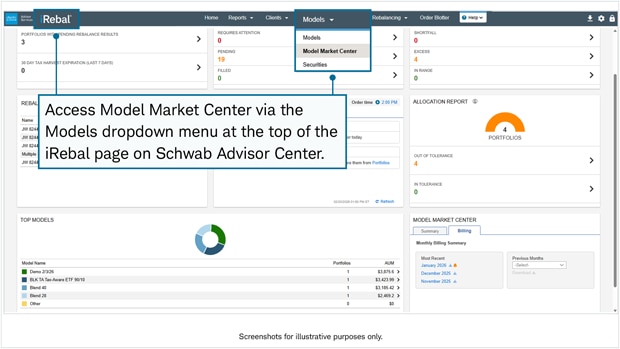

Access pre-built portfolio models without leaving Schwab Advisor Center

With Model Market Center™, you can take a more flexible approach to portfolio construction while potentially saving time and money. Hundreds of pre-built models are available from recognized money managers, who are all vetted by Schwab Center for Financial Research. There's no platform fee, no client paperwork, and no contracts with money managers; plus, most models are available without a Strategist Fee.1

And did we mention that you don't need to leave Schwab Advisor Center?

Model Market Center is powered by iRebal®, our advanced rebalancing tool that's integrated directly into Schwab Advisor Center. With iRebal's technology, you can not only create blended models but also mix and match models with your own in-house strategies for a truly customized approach. You have full control to decide what's best for your clients without the extra legwork.

New to Model Market Center? If you're already an iRebal user, you can access Model Market Center via the Models dropdown menu at the top of the page or via the Model Market Center portlet near the bottom of the iRebal homepage.

New to iRebal? Take this short survey to request access for your firm.

Hear from experts. The Model Market Center team is hosting a webcast with two model providers on Tuesday, March 24, at 10 a.m. PT/1 p.m. ET. Whether you're a new or seasoned user, register to join us for a platform overview and fresh insights into how advisors use Model Market Center and blended models in their practice.

March 2026 (0326-JZ59)

1. The terms, service fees, transaction fees and rates in the Charles Schwab Pricing Guide. For Clients of Independent Investment Advisors ("Pricing Guide") shall apply. For models that charge a Strategist Fee, the Strategist Fee, in basis points, is set by the model manager and can be seen directly on the model page in Model Market Center™. These fees are separate and distinct from the fees and expenses charged by mutual funds or exchange traded funds (described in each fund's prospectus) to their shareholders, which generally include a management fee and other fund expenses.

For general informational and educational purposes only.

Schwab does not provide investment planning, legal, regulatory, tax, or compliance advice. Consult professionals in these fields to address your specific circumstances.

iRebal® is a technology offering of Schwab.

Model Market Center™ (MMC) is a web-based offering available to independent investment advisors that custody assets at Charles Schwab & Co., Inc. (Schwab) and use the iRebal® platform available on Schwab Advisor Center for account rebalancing and trading. Schwab is a registered investment adviser and a subsidiary of The Charles Schwab Corporation. Please refer to Schwab's disclosure brochure for important information and disclosures relating to MMC.

Material made available through MMC is provided by affiliated and unaffiliated model managers (Model Managers) and information providers. Schwab has not paid for or been involved in the preparation of the content, and has not verified, endorsed, or approved the content. Schwab assumes no responsibility for any fact, recommendation, opinion, or advice contained in any such model portfolio or materials and expressly disclaims any responsibility for any investment decisions or for the suitability of any security or transaction based on it. Any mention of specific Model Managers and/or models should not be considered a recommendation or endorsement from Schwab. Schwab reviews model managers for eligibility criteria and conducts operational due diligence on the unaffiliated model managers but does not approve or review the models that Model Managers seek to include on MMC. Schwab does not conduct any investment due diligence of models or review or verify the accuracy or adequacy of information regarding Model Managers' MMC models. Users of MMC are responsible for selecting MMC models and implementing investments that meet their advisory clients' investment needs through their own, independent research and due diligence.

Schwab and Informa Business Intelligence, Inc. are separate, unaffiliated companies. Schwab and Informa Business Intelligence, Inc. are not responsible for each other's opinions, policies, and services. Certain model attributes are sourced from Informa PSN. The PSN Data Set is supplied by Zephyr, a Division of Informa Business Intelligence, Inc. The PSN Data Set may not be copied or distributed. It is not warranted to be accurate, complete, or timely.

Schwab typically receives remuneration from ETFs and mutual funds and/or their managers that participate in MMC for administrative and/or other services.

MMC leverages iRebal® to provide independent RIAs access to model portfolios provided by Model Managers.

The Schwab Center for Financial Research is a division of Charles Schwab & Co., Inc.

The comments, views, and opinions expressed in the presentation are those of the speakers and do not necessarily represent the views of Charles Schwab.

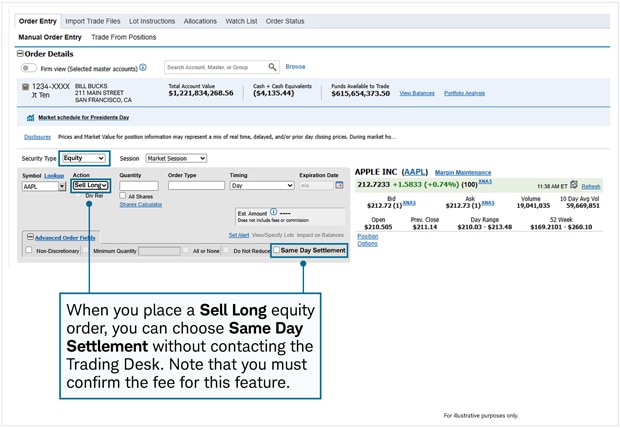

Same-day settlement is now available for equity sell orders

Previously, the only way to sell securities in a client's account with same-day cash settlement was to place a call to the Trading Desk. Now you can select same-day cash settlement directly from the Trading tab on Schwab Advisor Center.

When the Security Type is set to Equity, expand the Advanced Order Fields menu and click the Same Day Settlement checkbox. You will be asked to confirm the early settlement fee for the transaction. Once you agree, you can submit the order or add it to the Trade Blotter. Same Day Settlement orders can be identified on the Trade Blotter by the SDS indicator in the Special Conditions column.

To verify the order after submission, add the Settlement Date column to the order status view. The settlement date should match the order's execution date.

January 2026 (0126-V08K)

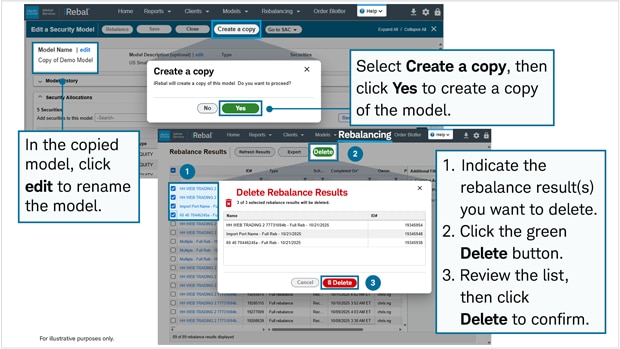

The latest iRebal® enhancements: New features based on user feedback

iRebal has implemented several enhancements to improve flexibility and the user experience, ensuring that it continues to meet your evolving needs.

The following enhancements were based on valuable feedback from users like you:

- The new Wash Sales Warning on Sells/Allow Buys option adds more flexibility to how iRebal handles wash sales during rebalances. Previously, only buy orders were flagged for potential wash sales, while sell orders were not. Now, potential wash sales on sell orders will also be flagged with a "W" in the Wash Sale column on the Rebalance Result Summary and Portfolio Result Detail pages. When potential wash sales are detected on buy orders, you can specify wash sale alternatives to avoid the wash sale. If no alternative is available, you can choose to remove the buy or allow the wash sale buy, depending on the account type.

- The Max Cash and Use Model Cash features now offer greater flexibility and control. You can set a cash maximum at the individual account level, which is automatically aligned with your current cash target. Additionally, the Use Model Cash option, previously available only in global settings, can now be configured at the account level.

- Navigating to Schwab Advisor Center is now easier with direct links on many iRebal pages, making research and task performance more convenient.

- With Copy Model and Delete Rebalance Results, you can now copy and modify existing models by choosing Create a copy from the Models menu or from the Edit a Security Model screen, available for both security models and blended models. You can also remove rebalances that are no longer needed by checking the results and clicking the Delete button at the top of the page.

Questions? Contact the iRebal support team at 855-640-2472. If your firm does not yet have access to iRebal and you would like to leverage these and other features, please complete the interest survey.

December 2025 (1225-C1KM)

iRebal® is a technology offering of Schwab. Rebalancing does not protect against losses or guarantee that an investor's goals will be met. Market volatility, volume, and system availability may delay account access and trade executions.

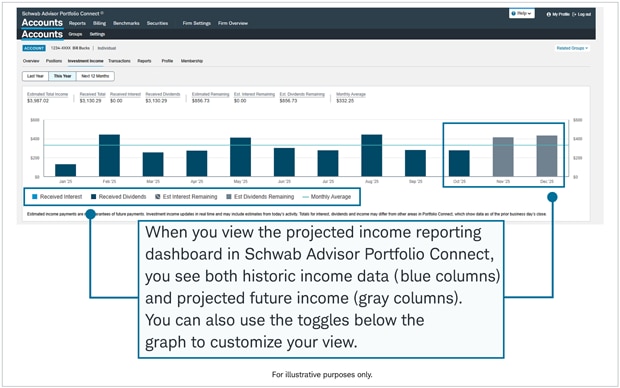

View historical and projected account income in Schwab Advisor Portfolio Connect®

Schwab Advisor Portfolio Connect's reporting dashboard has expanded to present projected income data in addition to the historical data that was already available. The projection is presented in an interactive graph that maps out 12-month forward-looking average monthly income estimates, which can help facilitate conversations with clients. To learn more about Schwab Advisor Portfolio Connect, visit the Schwab Performance Technologies® website.

November 2025 (1125-5V2N)

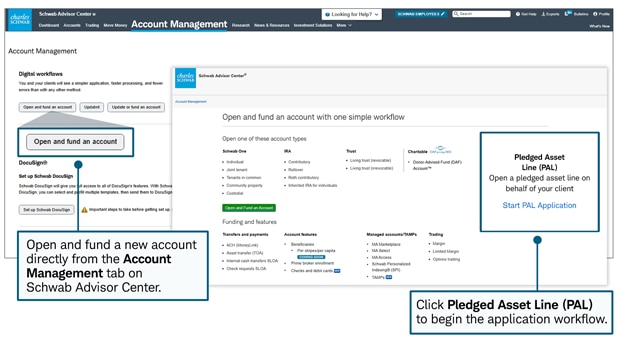

Making pledged asset lines a better experience for you and your clients

We constantly strive to bring you and your clients a better lending experience. Over recent months, we have made multiple enhancements to our Pledged Asset Line product—a flexible line of credit that gives your clients access to cash for personal or business needs without having to liquidate securities.

- Digital PAL applications now support layered entities and non-matching borrowers/pledgors.

- Schwab MoneyLink® is now available for PAL accounts.

- Trust certificates (when applicable) are now part of the Docusign™ package.

- Digital wires enable clients to draw on their PAL account within Schwab Alliance.

- The expanded digital application workflow supports transitioning a third-party securities-based line of credit to a PAL account.

And with our seamless and intuitive digital application process, loans are funding in 1.4 days on average, and many open within minutes.

Existing advisors can open and fund a PAL account today. Learn more about the digital application process.

Questions? Contact your Regional Banking Manager or call 800-986-3700.

September 2025 (0925-R29F)

Investment and Insurance Products: Not a Deposit • Not FDIC Insured • Not Insured by any Federal Government Agency • No Bank Guarantee • May Lose Value

This material is for registered investment advisor use only. This material may not be forwarded or made available, in part or in whole, to any party who is not a financial professional.

Investors should consider carefully information contained in the prospectus, or if available, the summary prospectus, including investment objectives, risks, charges and expenses. You can obtain a prospectus, or if available, a summary prospectus by visiting www.schwabassetmanagement.com/prospectus. Please read it carefully before investing.

The Pledged Asset Line is a demand line of credit provided by either Charles Schwab Bank, SSB, or Charles Schwab Premier Bank, SSB, (each, an Affiliated Bank and together, the Affiliated Banks). As a non-purpose line of credit, proceeds may not be used to purchase securities, pay down margin loans, or be deposited into any brokerage account.

Entering into a Pledged Asset Line and pledging securities as collateral involves a high degree of risk. You are pledging securities, the value of which is affected by events outside your control. Market fluctuations may cause the value of your pledged assets to decline.

For Charles Schwab Bank & Charles Schwab Premier Bank Pledged Asset Line (PAL) Investor Advantage Pricing (IAP): Loans are eligible for only one IAP discount per loan. PALs are eligible for an interest rate discount between 0.25% and 1.00% based on Borrower's Schwab brokerage and Schwab Bank combined qualifying assets totaling $250,000 or greater. Loans to organizational borrowers are not currently eligible for IAP discounts. Access your account at schwaballiance.com and review the PAL product page under Bank Offerings for additional details.

Charles Schwab & Co., Inc. and Charles Schwab Bank, SSB are separate but affiliated companies and subsidiaries of The Charles Schwab Corporation. Brokerage products are offered by Charles Schwab & Co., Inc., Member SIPC. Deposit products and services are offered by Charles Schwab Bank, SSB, Charles Schwab Premier Bank, SSB, and Charles Schwab Trust Bank, Members FDIC. Schwab Advisor Services™ provides custody, trading, and the support services of Charles Schwab & Co., Inc. ("Schwab"), member SIPC, to independent investment advisors and Charles Schwab Investment Management, Inc. ("CSIM"). Independent investment advisors are not owned by, affiliated with, or supervised by Schwab.

Charles Schwab & Co., Inc. is not an FDIC-insured bank and deposit insurance covers the failure of an insured bank.

Schwab Advisor Services™ provides custody, trading, and the support services of Charles Schwab & Co., Inc. ("Schwab"), member SIPC, to independent investment advisors and Charles Schwab Investment Management, Inc. ("CSIM").

©2025 Charles Schwab & Co., Inc. All rights reserved. Member SIPC.

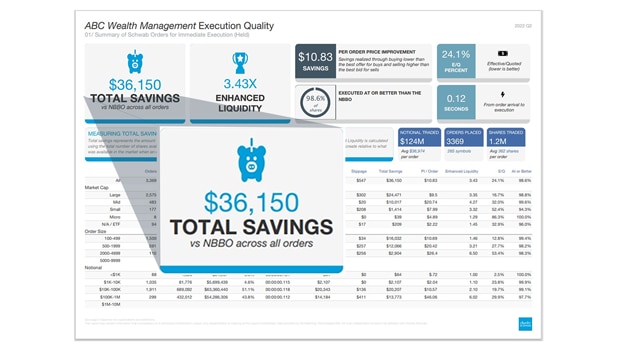

Oversized or illiquid block orders? The Block Desk can help.

Schwab's Block Desk helps free up your time so that you can focus on your clients while still getting a quality price on block orders. The Block Desk team can source liquidity for oversized equity, ETF, and options trades while minimizing market impact. And because each trade situation is unique, they can even help you develop and implement trading strategies that fit each client's objectives.

If you're looking to refine your trading process, the team can also provide you with a Post Trade Execution Quality Report, where you can compare your results against industry benchmarks.

You'll also be able to:

- Measure the quality of executions at Schwab on a quarterly basis

- See high-level insights into price improvement, how liquidity is sourced, and the speed of execution

- Get a detailed look into individual orders

- Consult the Block Desk to enhance your decision-making process and support regulatory compliance

To request a Post Trade Execution Quality Report, submit a service request on Schwab Advisor Center, choose Blotter & Post Trade Reports for the topic, and Quarterly Execution Quality Report for the subtopic.

July (0725-6U46)

Simplify portfolio construction with Model Market Center

Spending too much time on portfolio construction and investment management? Model Market Center™ may be able to help.

Model Market Center, accessed through Schwab's iRebal® platform, is a model delivery platform that can help simplify the portfolio construction process by enabling advisors to subscribe to models and apply them, as is, to client portfolios—or use iRebal to create blended models or design custom models with ease.

With Model Market Center, you can:

- Research hundreds of models from recognized money managers, most available without a Strategist Fee1

- Evaluate portfolio risk, performance, and asset mix

- Customize portfolios based on each client's individual goals

- Retain control over rebalancing and trading decisions using iRebal

And there is no cost to access the platform, no contracts for you to sign with money managers, and no client paperwork required to use the models.

To help maintain a high-quality list of models, Schwab has established platform eligibility criteria, including an operational due diligence review by Schwab Center for Financial Research, for all providers prior to permitting them to list models on the platform.

Learn more about Model Market Center or contact the iRebal support team at 855-640-2472 for help getting set up.

April 2025 (0525-UBUW)

1. Standard Schwab custody fees and fund management fees apply. For models that charge a Strategist Fee: The Strategist Fee, in basis points, is set by the model manager and can be seen directly on the Model Detail page in Model Market Center.

Model Market Center™ (MMC) is a web-based offering available to independent investment advisors that custody assets at Charles Schwab & Co., Inc. (Schwab) and use the iRebal® platform available on Schwab Advisor Center for account rebalancing and trading. Schwab is a registered investment adviser and a subsidiary of The Charles Schwab Corporation. Please refer to Schwab's disclosure brochure for important information and disclosures relating to MMC.

Material made available through MMC is provided by affiliated and unaffiliated model managers (Model Managers) and information providers. Schwab has not paid for or been involved in the preparation of the content, and has not verified, endorsed, or approved the content. Schwab assumes no responsibility for any fact, recommendation, opinion, or advice contained in any such model portfolio or materials and expressly disclaims any responsibility for any investment decisions or for the suitability of any security or transaction based on it. Any mention of specific Model Managers and/or models should not be considered a recommendation or endorsement from Schwab. Schwab reviews model managers for eligibility criteria and conducts operational due diligence on the unaffiliated model managers but does not approve or review the models that Model Managers seek to include on MMC. Schwab does not conduct any investment due diligence of models or review or verify the accuracy or adequacy of information regarding Model Managers' MMC models. Users of MMC are responsible for selecting MMC models and implementing investments that meet their advisory clients' investment needs through their own, independent research and due diligence.

Schwab and Informa Business Intelligence, Inc. are separate, unaffiliated companies. Schwab and Informa Business Intelligence, Inc. are not responsible for each other's opinions, policies, and services. Certain model attributes are sourced from Informa PSN. The PSN Data Set is supplied by Zephyr, a Division of Informa Business Intelligence, Inc. The PSN Data Set may not be copied or distributed. It is not warranted to be accurate, complete, or timely.

Schwab typically receives remuneration from ETFs and mutual funds and/or their managers that participate in MMC for administrative and/or other services.

MMC leverages iRebal® to provide independent RIAs access to model portfolios provided by Model Managers.

The Schwab Center for Financial Research is a division of Charles Schwab & Co., Inc.

Automated rebalancing and trading now available in iRebal®

Looking for a way to streamline portfolio management for accounts with less complex needs? Look no further!

New automation capabilities help you take full advantage of the scale and flexibility that iRebal has to offer. With the automated rebalancing and trading feature in iRebal, each portfolio can be scheduled to rebalance at any interval, with numerous rebalance types available (e.g., full rebalance, managing cash, invest cash only, generate cash only). Once scheduled, portfolio rebalances are calculated at the start of the day and available for review. At your selected trading time, trades are validated, combined into block trades, and submitted automatically. For added convenience, portfolios using models from Model Market Center™ can also be configured as part of the automation process.

And to eliminate the need for manual data entry, we added Distribution Cash Hold, which automatically pulls in any upcoming scheduled distributions (checks, internal transfers, ACH, and wires) and sets the account cash floor accordingly.

Access to the automated rebalancing and trading feature is controlled by your firm security administrator via the Access iRebal Automation security function.

View the iRebal User Guide to learn more.

March 2025 (0325-ZE2L)

Real-time quotes, free of charge, available on thinkpipes®

With thinkpipes—Schwab's advanced equities, ETF, and options trading platform—you now have access to indicative streaming real-time CBOE and NASDAQ U.S. equity proprietary quotes,1 as well as 15-minute-delayed OPRA quotes—free of charge.

Although NYSE, IEX, LTSE, MIAX, and MEMX live quotes are not included in the free feed, you can subscribe to live OPRA and real-time streaming NBBO quotes for a fee. Whichever option you choose, you can always view an NBBO snap quote at the time of order entry.

Not a thinkpipes user?

thinkpipes is designed to help you trade the way you want, with streaming market data, robust charting, and sophisticated portfolio analysis. To explore the platform's features, view this demo or schedule a one-on-one walkthrough with our thinkpipes Support Desk.

Monday-Friday, 8:00 a.m.-5:30 p.m. ET

866-547-8431

support-thinkpipes@schwab.com

1. Free indicative streaming real-time quotes provided will be within $0.01 of the NBBO 99% of the time.

Access to real-time market data is conditioned on acceptance of the exchange agreements. Fees apply. Market volatility, volume, and system availability may delay account access and trade executions.

Options carry a high level of risk and are not suitable for all investors. Certain requirements must be met to trade options through Schwab. Please read the Options Disclosure Document titled "Characteristics and Risks of Standardized Options." before considering any option transaction.

January 2025 (0125-D4FD)

Tax-sensitive portfolio management in iRebal

iRebal now supports tax-sensitive portfolio management.

There are two options: avoid short-term gains and avoid all gains. You can apply these choices to individual portfolios or to all of your firm's portfolios in the iRebal environment. Previously, to limit gains users were required to review position or lot-level details on suggested sells and edit as needed.

If you are interested in using the powerful tools on the iRebal platform, please complete the interest survey to add your firm to our weekly onboarding process.

To learn more, watch this short iRebal demo, review our iRebal interactive guide, and sign up for our weekly iRebal webcasts.

December 2024 (1224-8FVL)

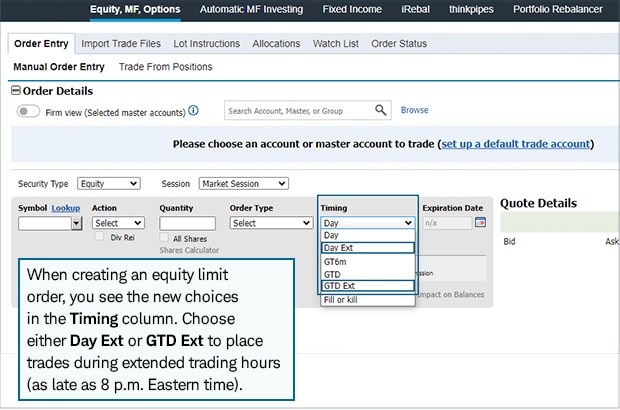

New timing choices let you keep orders active for extended trading sessions

New trading designations let you place equity orders that remain open outside of standard trading hours, providing more flexibility and convenience to meet your clients' needs.

Because you can now place limit trades that are active in more than one trading session, you can capitalize on breaking news—such as after-hours earning reports—that could impact your trading strategy.

The new Day Ext and GTD Ext designations are available only for limit orders placed through the Manual Order Entry, Import Trade Files, or Order Status page. These orders are active during all trading hours, from 7 a.m. to 8 p.m. Eastern time. GTD (good-till-date) orders can be placed until the expiration date you choose—between 1 and 180 calendar days after the order is opened.

When using the Import Trade Files page, please note that this feature is currently available only for trades that are manually added to that blotter. A future enhancement will expand support so you can import trades designated for extended hours.

October 2024 (1024-TDCX)

iRebal is now available to all firms—take an interest survey to get started

iRebal is now available for use by all firms that custody assets with Schwab.

When we started offering iRebal integration last year, the response was overwhelming, with 2,000 firms expressing interest. We have since offered iRebal access to those firms and are pleased to announce that we can now offer access to any firm that is ready to take advantage of this powerful tool.

iRebal is Schwab's premier rebalancing platform, designed to integrate seamlessly into your firm's workflows, and once you've customized it to your preferences, can shorten manual rebalancing efforts from weeks to hours. It is a customizable, rule-based program that uses real-time balances and positions to offer you more effective portfolio management. It has tools to handle tax-efficient rebalancing, dynamic cash management, tax-loss harvesting, and more. iRebal is free for all accounts custodied with Schwab. And because iRebal is an integral part of Schwab Advisor Center, implementation is simple.

As we announced last month, we are enhancing both the iRebal platform and Model Market Center (which offers access to hundreds of models from leading money managers, most with no fee). Further enhancements are planned for this year, so there's never been a better time to get started.

Simply complete the interest survey to add your firm to our weekly onboarding process.

To learn more, watch this short iRebal demo, review our iRebal Interactive Guide, and sign up for our weekly iRebal webcasts.

September 2024 (0924-NTAR)

Place "good till date" orders for equities and options

Advisors can now designate orders for equity and options trades as "good till date" (GTD).

With this new feature, advisors can select an order expiration date between the next business day and up to 180 calendar days. Previously, only "good till cancelled" (GTC) orders were available, which expired in 180 calendar days.

A new Expiration Date column on the Order Status and Blotter screens makes it easy to track this new order type. You can add this column to your existing views and export or print the data for your records.

This new order type is available on the following pages of the web trading platform:

- Manual Order Entry

- Import Trade Files (Add Order only; GTD import order functionality is on the horizon)

- Order Status

As part of this enhancement, all GTC-designated orders will be updated to GT6m, or "good till 6 months," which is the designation used on Schwab's other trading platforms.

September 2024 (0924-NTAR)

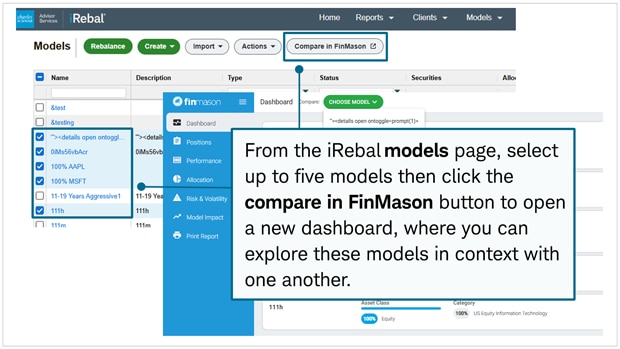

New enhancements to Model Market Center™ are now available to iRebal users

Model Market Center is one of the most powerful tools available on the iRebal platform, offering access to hundreds of models from recognized money managers. Most models are available without a Strategist Fee1 and money managers who list models are covered by Schwab Center for Financial Research. With recent enhancements, it's now even better. New features that users will enjoy:

- Subscribe to up to five models at a time, then immediately leverage those models—assign them to portfolios, create new blended models, or add them to an existing blended model—all through a single intuitive workflow.

- Use enhanced filtering capabilities to customize your view of models. Easily resize, reorder, or hide columns to suit your needs, making it quick and easy to view and work with the models you need.

In addition, we are pleased to announce that all firms that have previously requested access to iRebal have been onboarded to the platform, so new firms can now get access in a matter of days, with no extended delays.

To get started, please complete our iRebal interest survey today. It provides us with important details about your firm's rebalancing needs and is your first step to accessing exciting tools like Model Market Center.

August 2024 (0824-HATH)

1. Standard Schwab custody fees and fund management fees apply. For models that charge a Strategist Fee: The Strategist Fee, in basis points, is set by the Model Manager and can be seen directly on the model page in the Model Market Center.

Model Market Center™ (MMC) is a web-based offering available to independent investment advisors that custody assets at Charles Schwab & Co., Inc. (Schwab) and use the iRebal® platform available on Schwab Advisor Center for account rebalancing and trading. Schwab is a registered investment adviser and a subsidiary of The Charles Schwab Corporation. Please refer to Schwab's disclosure brochure for important information and disclosures relating to MMC.

Material made available through MMC is provided by affiliated and unaffiliated model managers (Model Managers) and information providers. Schwab has not paid for or been involved in the preparation of the content, and has not verified, endorsed, or approved the content. Schwab assumes no responsibility for any fact, recommendation, opinion, or advice contained in any such model portfolio or materials and expressly disclaims any responsibility for any investment decisions or for the suitability of any security or transaction based on it. Any mention of specific Model Managers and/or models should not be considered a recommendation or endorsement from Schwab. Schwab reviews model managers for eligibility criteria and conducts operational due diligence on the unaffiliated model managers but does not approve or review the models that Model Managers seek to include on MMC. Schwab does not conduct any investment due diligence of models or review or verify the accuracy or adequacy of information regarding Model Managers' MMC models. Users of MMC are responsible for selecting MMC models and implementing investments that meet their advisory clients' investment needs through their own, independent research and due diligence.

Schwab and Informa Business Intelligence, Inc. are separate, unaffiliated companies. Schwab and Informa Business Intelligence, Inc. are not responsible for each other's opinions, policies, and services. Certain model attributes are sourced from Informa PSN. The PSN Data Set is supplied by Zephyr, a Division of Informa Business Intelligence, Inc. The PSN Data Set may not be copied or distributed. It is not warranted to be accurate, complete, or timely.

Schwab typically receives remuneration from ETFs and mutual funds and/or their managers that participate in MMC for administrative and/or other services.

MMC leverages iRebal® to provide independent RIAs access to model portfolios provided by Model Managers.

The Schwab Center for Financial Research is a division of Charles Schwab & Co., Inc.