What's New: Other Enhancements

Schwab Advisor Center® has digital tools and resources to help you onboard new relationships, support your clients, and scale your business. Below you can learn about the latest enhancements and resources, or explore recent updates by clicking on a topic.

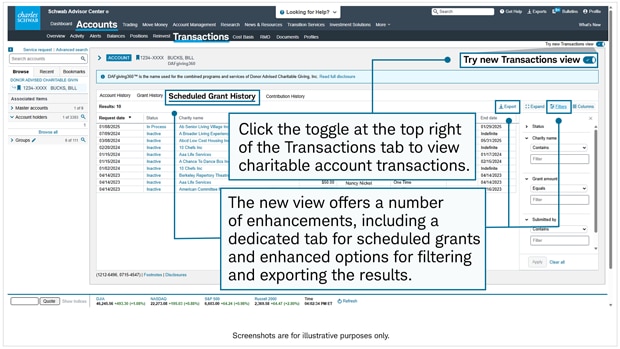

Charitable accounts are now visible on the redesigned Transactions tab

You can now review transactions in charitable accounts on the redesigned Transactions tab on Schwab Advisor Center.

With this enhancement, you can:

- Review grant history and scheduled grant history—each displayed on its own easy-to-read tab

- Leverage the modernized filter options now available

- Export transactions at the firm, master, group, or account level

To get started, click the Try new Transactions view toggle at the top right of the Transactions tab when you're viewing a charitable account.

January 2026 (0126-V08K)

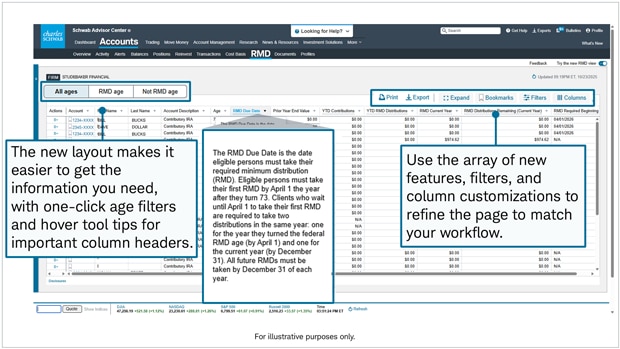

Welcome to the new required minimum distribution (RMD) experience

The RMD tab on Schwab Advisor Center has been completely redesigned to streamline your workflow when reviewing and managing your clients' retirement accounts. Based on advisor feedback, these enhancements vastly improve the usability of the page and let you customize the experience to meet your firm's unique needs. Here are some of the most important enhancements.

More view options and greater detail

- The new experience lets you view RMD data at the master, group, account holder, and account levels, whereas the previous RMD workflow could be viewed only at the firm level.

- Hovering over any column header that is underlined in blue dots displays a detailed tool tip explaining the data in that column.

Live account data that drives better decisions

- The new account view offers a unique layout that makes it easy to see key information—like current and prior year RMD and contribution details—at a glance.

- The live summary module compares available vs. unsettled cash, so you can be confident making distribution and contribution decisions.

Customize, filter, and act your way

- Narrow search results quickly with new All ages, RMD age, and Not RMD age filters.

- Rearrange the grid to show only the columns you need, then save that layout with a single click on the Apply button.

- Use the Actions dropdown menu to easily jump to the move money tool to make a contribution or satisfy an RMD.

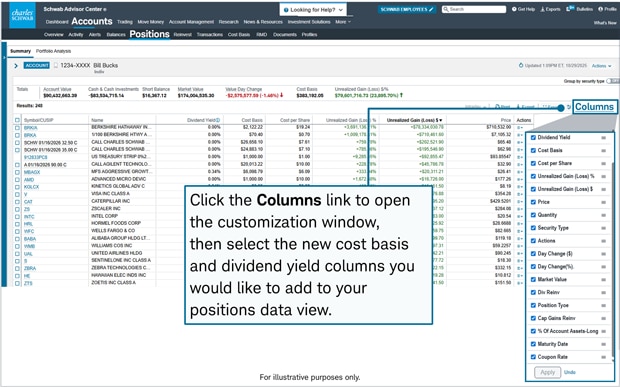

View cost basis and dividend yield information with new columns on the Positions page

Five new data columns displaying cost basis and dividend yield information are now available on the Positions page:

- Cost Basis*

- Cost per Share*

- Unrealized Gain (Loss) %1

- Unrealized Gain (Loss) $1

- Dividend Yield

*These columns are not displayed by default. To make them appear on your grid, turn them on manually in the Columns window.

1 Cost basis information displays only in the account view. This information is not available when viewing positions at the firm, master account, account holder, and custom group levels.

November 2025 (1125-5V2N)

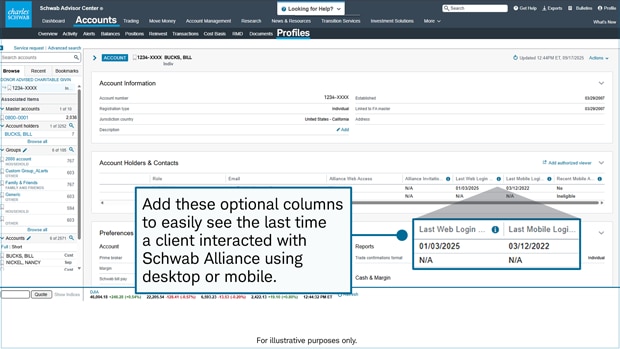

View your clients' most recent login to Schwab Alliance on the updated Profiles page

Now the Schwab Advisor Center Profiles page can display each client's last login date—the most recent time they logged into the Schwab Alliance website or accessed the platform via the Schwab Mobile app. You can see this information at the sub-account, account holder, group, master, and firm levels.

Use the Columns link on the Profiles page to view all available columns, then add the new information by clicking the checkboxes next to Last Web Login Date and Last Mobile Login Date. This information is updated overnight, so if the client logged in during the current day, that information won't appear until the next day.

You can use this information to identify those clients who are most comfortable using digital channels like Schwab Alliance so you can take advantage of our digital channels' security and efficiency with those clients.

October 2025 (1025-M3TL)

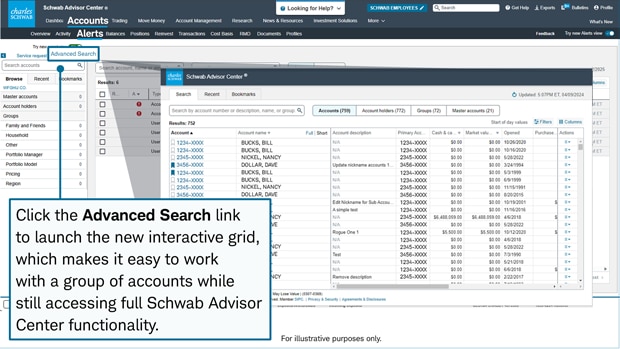

New pop-out panel makes it easy to group and work with accounts

Now you can open an interactive grid that makes it easy to create a working list of accounts you're reviewing. This new view helps streamline your interactions while maintaining access to the other Schwab Advisor Center functionality you rely on.

Click the Advanced Search link to open a window that allows you to:

- Browse accounts by group, master account, and owner

- Use sorting, filtering, and bookmarks

All the accounts you're working with on the new panel are mirrored on the page you're viewing in the main window.

October 2025 (1025-M3TL)

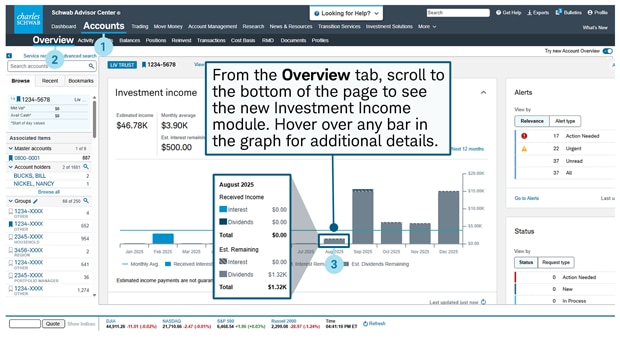

View dividend and interest income on the Overview tab

The Overview tab on Schwab Advisor Center has a new Investment Income module, which provides details about dividend and interest income in an account, along with a graphical representation of dividend and interest income over time. Hover over the bars in the graph to view more detailed information.

You can see both received income and an estimate of remaining income that has yet to enter the account at the account, account holder, or custom group level (note that only groups with fewer than 50 accounts can use this feature). You can also adjust the time period to view the current or previous year or a rolling 12-month forward view.

October 2025 (1025-M3TL)

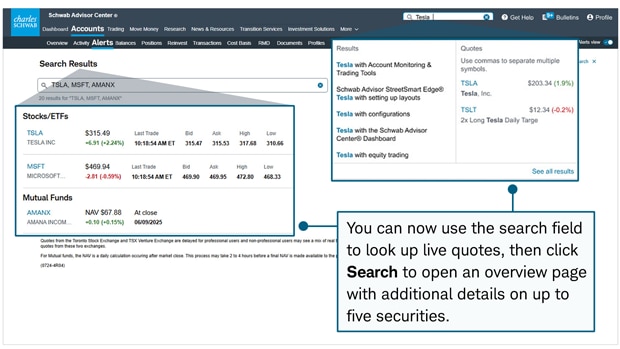

Use Schwab Advisor Center’s search function to find security information

Now you can use the same search feature you use to find tools and information on Schwab Advisor Center to quickly look up security quote data.

This easy, intuitive option means you no longer need to interrupt your workflow to review this information: Simply type the name of the security into the search field, and an overlay displays a list of up to five options matching your search term. Tap Enter to open a landing page displaying high-level data about each security, including static real-time quotes and quick access to more research on each item.

July 2025 (0725-FFA6)

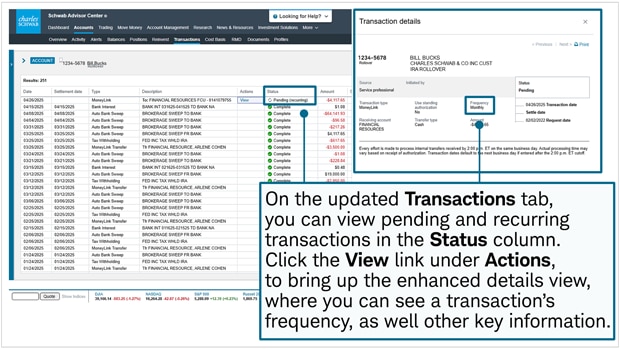

The redesigned Transactions tab puts more information at your fingertips

As we continue to modernize Schwab Advisor Center, we recently launched the new-and-improved Transactions tab. The redesigned experience improves the user interface and introduces new features that put more contextual information at your fingertips.

Enhancements include:

- You can now see both pending and recurring money movements in the grid view.

- You can click the View link in the Actions column to see the frequency of pending and recurring transactions in the new transaction details flyout.

- You can customize the aggregate transactions export options at the firm, master, group, or account level.

- You can view up to 10,000 accounts at a time, up from the previous limit of 1,000.

To get started, click the Try new Transactions view toggle in the top-right corner of the Transactions tab on Schwab Advisor Center.

May 2025 (0525-S74K)

New at-a-glance Quick Quote bar available on Schwab Advisor Center

The new Quick Quote bar offers at-a-glance security quote information without interrupting your workflow. You can find the Quick Quote bar at the bottom of the Dashboard, Accounts, Trading, and Research tabs on Schwab Advisor Center. On each of these pages, you'll see:

- A snapshot of the market

- Real-time individual security quotes

- Auto-suggested symbols as you type

- Quick access to additional research info

We are working on future enhancements to the Quick Quote bar, which we will share with you as they become available.

November 2024 (1124-16WF)

New features available on the header bar of Schwab Advisor Center

The newly redesigned navigation experience, available at the top of each page on Schwab Advisor Center, puts important functionality at your fingertips.

- The enhanced Search help and support bar auto-fills suggestions as you type. You can select or click a suggestion to go directly to the page you need, or you can press return and view a full search results page.

- The new Get Help menu replaces the Support dropdown, giving you access to relevant links, including the Service Guide, the RIA Ed Center™, service requests, and a Contact Us link that you can use to contact your service or sales team, the trading desk, technical support, and other important contacts at Schwab.

- When you're trying to download large amounts of data and your request can't be processed immediately, you can find your queued export tasks by clicking the Exports menu. When your request is ready, you'll see a number next to the Exports menu, indicating how many exports are ready for download. Click the link to review and download your requests.

- When you click Settings on the Profile menu, a modal window lets you update not only your contact information, role at your firm, and notification, as well as your login credentials and security information.

And, as always, you can use the What's New link to see important technology updates like this one!

July 2024 (0724-CCZA)

At-a-glance information from the new Account Overview dashboard

The new Account Overview dashboard makes it easy to see and act on client account data, including balances, positions, and other key information, without the need to navigate to multiple pages. The dashboard features a number of modules:

- Real-time balances, including total value, cash, short balances, funds available to trade, purchased funds, and balances over time

- A snapshot of the account's asset mix, along with other high-level performance calculations for various time horizons

- Profile data, including contact and master information on the account and account-holder level; for details click the Go to Profile link

- Stay up-to-date with all the account's important alerts; if you need to take action, click the Go to Alerts link to view the Alerts tab

- View status updates at the firm and master account level in a convenient module; to address items that need action, click the link to view the Status page

June 2024 (0624-518X)

New features bring more key Schwab Advisor Center data into Salesforce

We've incorporated some of your most requested features into our Salesforce application, minimizing the need to switch between Salesforce and Schwab Advisor Center while working in your account.

Here are some key highlights:

- Required minimum distribution (RMD). This feature adds 32 new fields to the Schwab account record, offering comprehensive information about your clients' RMD statuses and history. The data is automatically updated during the daily scheduled downloads, ensuring accurate, up-to-date insights.

- Account roles. A new custom account role is now linked to the Schwab account in Salesforce. You can easily view beneficiary account roles categorized by role type, name, and percentage. Data updates are automatically synchronized during the daily scheduled downloads.

- Standing authorization. This feature introduces a custom standing authorization object that you can view for each Schwab account in the Salesforce application. Updates to standing authorizations are made at the account level. You have the flexibility to retrieve this information on-demand using the Update Schwab Standing Instructions button or through the Real-Time Standing Instructions Update page element, which automatically retrieves the data each time the page is opened and refreshed.

- Single sign-on to move money. The new single sign-on (SSO) capability for money movements complements the existing SSO functionality for Account Details and Documents. Now you can easily access the move money tool on Schwab Advisor Center in a new window—while staying within the context of your original account—saving you time and reducing the likelihood of errors.

- Update balances page element. We've also introduced a page element for updating balances to ensure that you always have access to the latest figures. You can update balances on-demand, using the existing Update Balance button or the Real-Time Balance Update page element, which automatically updates balances each time you open Account Details or refresh the page.

To begin using these enhancements, please contract our service team at 888-400-5067. For more information, view the Schwab Advisor Center Integration for Salesforce user guide.

June 2024 (0624-518X)

Now access Morningstar Direct Compass from the Research tab

The Research tab on Schwab Advisor Center now offers a single-sign-on link to Morningstar's Direct Compass tool, giving you access to leading investment research directly from Schwab Advisor Center. You can also customize your experience and save the changes to ensure that you always get the information you need quickly and easily.

The new link is under Morningstar in the Market Reports section of the Markets page. It replaces the previous Analyst Research Center link. Enhanced customization and features include:

- Morningstar's independent and proprietary data, ratings, research, and analysis

- A powerful screener for searching securities across a variety of criteria

- Integrated watch lists

- A customizable dashboard

- Analyst coverage in equity, manager, and credit research, including global research and editorial content

Visit Morningstar to learn more about this powerful tool. (Note: This link opens an external website.)

March 2024 (0324-4DNK)