What's New: Digital Onboarding

Schwab Advisor Center® has digital tools and resources to help you onboard new relationships, support your clients, and scale your business. Below you can learn about the latest enhancements and resources, or explore recent updates by clicking on a topic.

Overview

Our digital onboarding capabilities on Schwab Advisor Center enable you to open, set up, and fund multiple accounts for a household in minutes—all with a single email from you to your client. It's the fastest and most secure way to open accounts at Schwab for both new and existing clients.

Using information from Schwab and third-party platforms, the completely digital workflow significantly reduces errors and delays by validating and securing the data and guiding you and your client through the account open process. With digital onboarding, you spend less time following up with clients while giving them a simpler, streamlined experience.

Explore the following resources to learn more about digital onboarding and scroll down to learn about the latest enhancements to the workflow.

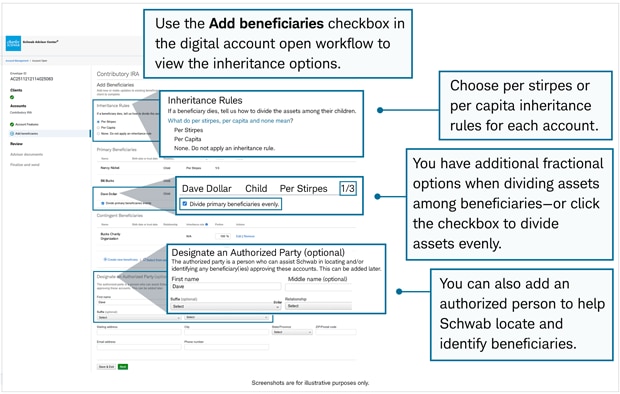

Now you have more beneficiary options when opening new accounts digitally

Now you have more powerful, customizable beneficiary designation options when opening an account using Schwab's digital tools.

These new options now appear at the beginning of the digital onboarding workflow, making it easier than ever to enter the relevant beneficiary information for your clients' accounts.

New features include:

- The ability to select per stirpes or per capita inheritance rules when creating an account; the rule you select will automatically apply to all eligible beneficiaries unless you exclude them

- The ability to add information for up to 10 primary and 10 contingent beneficiaries, Social Security number or taxpayer identification number, address, email, phone number, and relationship to the account owner(s)

- The ability to select fractional assignments (1⁄3, 1⁄6, 1⁄7) as needed to divide inheritance among beneficiaries

- The ability to add an inheritance rule and include an authorized party to help identify and locate beneficiaries

- The ability to name a custodian to manage beneficiary assets from a brokerage account on behalf of a minor

- The ability to select a beneficiary, once their information has been entered, for additional accounts; all relevant data for that beneficiary will auto-populate

January 2026 (0126-V08K)

Enhanced, customizable options for issuer communications available in digital onboarding

Now, when you're opening a new account with digital onboarding, you can specify different parties to receive or take action on various issuer communications.

Communications you can designate include:

- Corporate actions

- Interim mailings

- Proxy voting

For example, you could assign interim mailings to be delivered to the client, while proxy ballots could be sent to your firm. You can also request copies to be sent to the parties who aren't receiving the originals.

December 2025 (1225-GNUH)

Add your firm's fillable documents to a digital envelope for clients to complete and sign

You can now add your firm's documents—including forms that clients complete and sign—to the digital onboarding workflow. Once you have created a fillable PDF using your preferred app, you can upload the PDF to the Advisor Documents section of the digital onboarding workflow or via the Saved Firm Documents screen on the Manage Schwab Envelopes page.

Clients can then input information into the fields you have indicated and add their digital signatures as a seamless part of the digital onboarding workflow. Once all signers have completed the envelope, you can view and download a receipt for each fillable document that details all client additions, edits, and signatures.

Tips for using the fillable documents feature

- Only documents that fall under the Documents for signature and Disclosure categories can be sent to clients as fillable forms.

- Use the toggle below each relevant document you upload to indicate that it is fillable and whether all signers or only the first signer can add information or edit the document.

- All signers can complete fields, input text, and add signatures during the approval process and can download all advisor documents that you send with the digital envelope.

Want to learn more?

For more details about this feature and how it fits into the digital onboarding workflow, sign up for an upcoming webcast, where a product expert will walk you through the new feature and answer your questions.

November 2025 (1125-5V2N)

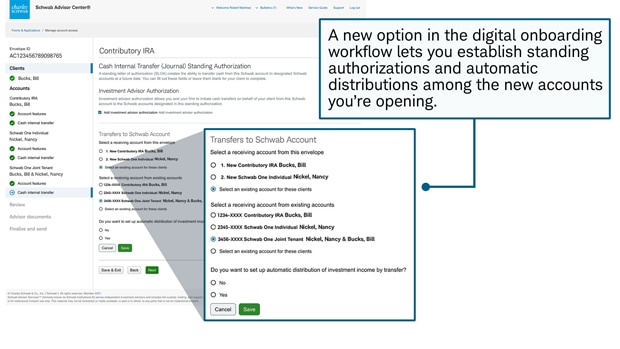

Generate standing authorizations and automatic distributions with digital onboarding

Now when you open new accounts in the digital onboarding workflow, you can establish internal transfer standing authorizations and automatic investment income distributions among new accounts in the same digital envelope. Previously, you had to wait until the accounts were opened before adding these features.

September 2025 (0925-4STS)

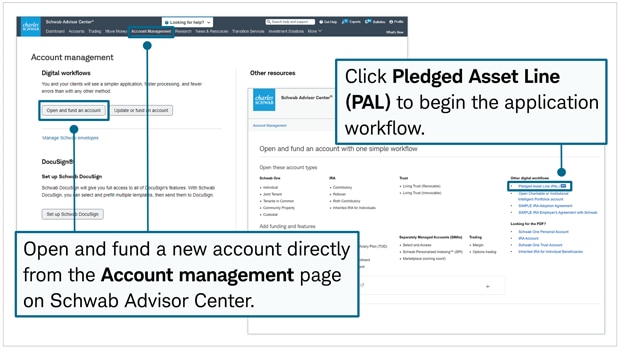

Digital applications for Pledged Asset Line® of credit

To help your clients leverage their investments and access cash for personal or business needs without having to sell securities, Schwab Bank offers a Pledged Asset Line of credit (PAL). A PAL is a non-purpose line of credit that allows a client to borrow against the non-retirement assets in their portfolio.

Secured by assets held in a Pledged Account maintained by Charles Schwab & Co., Inc., clients can use their PAL to access the funds they need while maintaining their investment strategy. A PAL can be used for a wide range of financial needs, including home renovations, college tuition, bridge funding for a new home, and much more. Clients may even qualify for interest rate discounts as part of Schwab's Investor Advantage Pricing program.

With our seamless and intuitive PAL digital experience, loans are opening within 14 days on average, and with straight-through-processing many lines are opened within hours.

Existing advisors can open and fund a PAL account today, check out rates, and learn more about the digital application process. Contact your Regional Banking Manager with questions or call 800-986-3700.

May 2025 (0525-D870)

Investment and Insurance Products: Not a Deposit • Not FDIC Insured • Not Insured by any Federal Government Agency • No Bank Guarantee • May Lose Value

This material is for registered investment advisor use only. This material may not be forwarded or made available, in part or in whole, to any party who is not a financial professional.

Investors should consider carefully information contained in the prospectus, or if available, the summary prospectus, including investment objectives, risks, charges and expenses. You can obtain a prospectus, or if available, a summary prospectus by visiting www.schwabassetmanagement.com/prospectus. Please read it carefully before investing.

The Pledged Asset Line is an uncommitted demand line of credit provided by either Charles Schwab Bank, SSB, or Charles Schwab Premier Bank, SSB. Entering into a Pledged Asset Line and pledging securities as collateral involves a high degree of risk. As a non-purpose line of credit, proceeds may not be used to purchase securities, pay down margin loans, or be deposited into any brokerage account. Access your account at schwaballiance.com and review the PAL product page under Bank Offerings for additional details. Before you decide to apply for a Pledged Asset Line, make sure you understand the risks. A Pledged Asset Line requires a brokerage account at Charles Schwab & Co., Inc.

For Charles Schwab Bank & Charles Schwab Premier Bank Pledged Asset Line (PAL) Investor Advantage Pricing (IAP): Loans are eligible for only one IAP discount per loan. PALs are eligible for an interest rate discount between 0.25% and 1.00% based on Borrower's Schwab brokerage and Schwab Bank combined qualifying assets totaling $250,000 or greater. Loans to organizational borrowers are not currently eligible for IAP discounts. Access your account at schwaballiance.com and review the PAL product page under Bank Offerings for additional details.

Charles Schwab & Co., Inc. and Charles Schwab Bank, SSB are separate but affiliated companies and subsidiaries of The Charles Schwab Corporation. Brokerage products are offered by Charles Schwab & Co., Inc., Member SIPC. Deposit products and services are offered by Charles Schwab Bank, SSB, Charles Schwab Premier Bank, SSB, and Charles Schwab Trust Bank, Members FDIC. Schwab Advisor Services™ provides custody, trading, and the support services of Charles Schwab & Co., Inc. ("Schwab"), member SIPC, to independent investment advisors and Charles Schwab Investment Management, Inc. ("CSIM"). Independent investment advisors are not owned by, affiliated with, or supervised by Schwab.

Charles Schwab & Co., Inc. is not an FDIC-insured bank and deposit insurance covers the failure of an insured bank.

Schwab Advisor Services™ provides custody, trading, and the support services of Charles Schwab & Co., Inc. ("Schwab"), member SIPC, to independent investment advisors and Charles Schwab Investment Management, Inc. ("CSIM").

©2025 Charles Schwab & Co., Inc. All rights reserved. Member SIPC.

Send ACH setup for multiple accounts for client approval in one digital envelope

Now you can use the existing ACH digital workflow to set up ACH profiles for multiple accounts in a single digital envelope. Previously, if clients wanted an ACH on each of their accounts, you had to send a different envelope for each authorization. With this enhancement, you can send one email to your client that will let them link an external account to as many as 10 Schwab accounts in a single approval process. And best of all, you don't have to re-enter the account information each time—the information you've already entered will be available via a drop-down menu.

Please note: For each account added, at least one Schwab account holder must be on the external account.

To use this new feature, set up the first ACH using the digital account management workflow. You'll see an option allowing you to add another account to the envelope. Use this link to add up to nine additional accounts, then send the envelope to your client to eAuthorize.

Note that if clients are required to upload bank documents for additional verification, the system will automatically apply that upload to all instructions in the envelope.

For details about this enhancement, as well as our other account management workflows, use our interactive guide.

April 2025 (0425-C089)

Update information for new clients without recalling a digital envelope

This enhancement makes it possible to correct details for new-to-Schwab clients—email address, phone numbers, and other information—after the digital onboarding envelope has been sent for client approval, without the need to recall and resend it.

To make changes, navigate to the Manage Schwab Envelopes page from the Account Management page; use the drop-down menu to select Edit client profile.

Previously, advisors had to cancel the envelope and resend it to update these details—meaning that any clients who had already approved would have to go through the process again. This was a top feature request for many firms and should improve efficiency, especially for firms that open many accounts.

Please note: Details for existing Schwab clients cannot be updated using this method.

February 2025 (0225-NFPV)

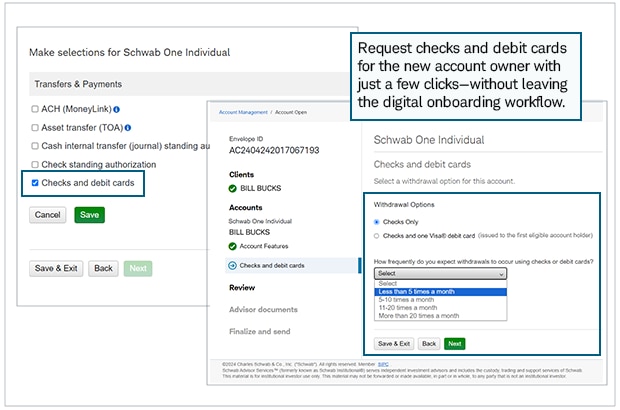

Now request checks and debit cards seamlessly with digital onboarding

As part of the digital onboarding workflow, you can now request checks and debit cards for clients—no paper forms, wet signatures, or service request submissions required.

Simply click the relevant checkboxes and answer a few security questions about monthly transaction volume, and the requested items will be sent automatically to your client's address of record.

This enhancement addresses even more of your clients' needs while also reducing possible errors and delays in delivering checks and debit cards that can result when submitting paper forms and signature cards.

November 2024 (1124-16WF)

Open charitable accounts with digital onboarding

You can now open charitable accounts for your clients using Schwab's digital onboarding workflow. These accounts will then be approved by clients and opened using the same fast, secure, efficient tools that make digital account open a great choice when opening most client accounts. The benefits of digital onboarding include:

- Using a guided workflow that auto-fills client information from Schwab and leading third-party platforms, saving time and reducing errors

- Funding the account without ever leaving the workflow

As always with digital onboarding, you will experience a workflow proven to reduce errors and speed the time it takes for processing and funding. Your clients can also quickly and securely approve the request on their desktop or mobile device, using eAuthorization.

October 2024 (1024-TDCX)

Open TAMP accounts with fast, secure digital onboarding

Firms that use turnkey asset management program (TAMP) providers can now open TAMP accounts using Schwab's digital onboarding workflow. This means both authorized agents from your firm as well as the authorized TAMP provider can use the same fast, secure, efficient tools you use to open and fund other Schwab accounts.

When opening TAMP accounts, the benefits of digital onboarding include:

- Using a guided workflow that auto-fills client information from Schwab and leading third-party platforms, saving time and reducing errors

- Funding the account without ever leaving the workflow

- Opening multiple accounts with a single digital envelope

- Managing the digital envelopes for account open together with the TAMP provider

Please note: Because the TAMP provider will not have access to your firm's master accounts, the system will not auto-fill client information. The TAMP provider's agents must manually enter the master account number associated with the TAMP SL in the digital workflow.

September 2024 (0924-NTAR)

Now send checks and debit cards seamlessly with digital onboarding

As part of the familiar digital onboarding workflow, you can now send checks and debit cards to clients with no paper forms, wet signatures, or service request submissions required.

Simply click the relevant checkboxes and answer a few security questions about monthly transaction volume, and the requested items will be sent automatically to your client's address of record.

This enhancement addresses even more of your clients' needs, while also reducing possible errors and delays in delivering checks and debit cards that can result when submitting paper forms and signature cards.

September 2024 (0924-NTAR)

Create custom document types and view client edits within digital onboarding

The latest upgrades to the digital onboarding workflow let you create and save custom document types for your firm's forms. You can also review your clients' edits to digital envelopes before submitting them to Schwab.

Save your firm's documents for easy use. Now you can create custom document types for your firm's forms, making it easy to add them to Schwab's digital envelopes when opening future accounts. Once they are saved, you can apply the documents to one or more master accounts, and they are automatically added to all future envelopes created under those master accounts.

From the Manage Schwab Envelopes page, choose the Saved Firm Documents link, select a category and a master account, then click Add new document type.

Review client edits before submitting digital envelopes to Schwab. Your clients may update or edit information in the envelope before signing electronically. A new indicator on the Manage Schwab Envelopes page shows that your client has made changes, so you can review them before you submit the envelope to Schwab. When you review the forms, client edits are automatically highlighted in blue, making to make it easy for you to see the changes. For comparison, you'll also see what was previously in those fields.

June 2024 (0624-518X)

Review your firm's documents before submitting signed digital envelopes to Schwab

Now you can download and review your firm's documents to ensure that they are in good order before submitting the digital envelope to Schwab. In addition, when you confirm receipt of these documents, you'll see your firm's logo at the top of the receipt, so it's easy to distinguish firm documents from Schwab forms at a glance.

Many firms add their own documents to digital onboarding envelopes before sending them to clients for approval. Previously, advisors could review their firm’s signed documents only after Schwab processed the account opening forms, which meant any client approval issues were noticed only after the account had been opened. With this enhancement, advisors can submit digital envelopes secure in the knowledge that they can review and confirm all firm-related paperwork before the account is opened.

May 2024 (0524-ZKVS)

Easily connect secondary link or block trade master accounts to accounts you open with digital onboarding

Many firms use secondary link (SL) or block trade (BT) master accounts to control employee access, link to third-party providers, or invest for clients via managed accounts. Now it is easier than ever to review and update these connections when opening new client accounts.

Based on the master account you select, the digital onboarding workflow automatically preselects the relevant SL or BT master accounts. You can then modify these selections as needed, helping streamline the process and reducing the need for follow-up.

April 2024 (0424-UY7P)

For advisor use only. For general educational purposes.

Any investments reflected are for illustrative purposes only and are not intended to be nor should they be construed as a recommendation to buy, sell, or continue to hold any investment. Screen shots are for illustrative purposes only, may be historical in nature, and should not be used as a basis for any investment decision.

Schwab Advisor Services™ includes the custody, trading, and support services of Charles Schwab & Co., Inc. ("Schwab"), a registered broker-dealer and member SIPC, and the technology products and services of Performance Technologies, Inc. ("PTI"). PTI and Schwab are separate companies affiliated as subsidiaries of The Charles Schwab Corporation, but their products and services are independent of each other. PTI's integration solutions integrate data about accounts custodied at Schwab.

API integration is available through Schwab OpenView Gateway®, which is provided by PTI. Single sign-on is provided by PTI. Daily data files and trading integration are available through Schwab. Schwab OpenView Gateway® and Schwab OpenView MarketSquare™ are services of PTI.

References to third parties (whether such parties are vendors participating in a service of PTI or independent advisors using a service of a participating vendor) are not an endorsement or recommendation of, or an opinion (favorable or unfavorable), or advice about, or a referral to any product or service of any third party. Advisors are solely responsible for evaluating, selecting, and purchasing products and services offered by third party vendors. Unless indicated otherwise, third parties are independent and not affiliated with PTI or its affiliates.

Schwab Performance Technologies® ("SPT") provides technology solutions to independent investment advisors, while Schwab provides them and their clients with custody, trading, and related support services. SPT and Schwab are separate companies affiliated as subsidiaries of The Charles Schwab Corporation, but their products and services are independent from each other.

Schwab Advisor Portfolio Connect™ is a product of SPT.

Institutional Intelligent Portfolios ("IIP") is a technology and service platform made available by SPT to independent advisors who maintain a business relationship with Schwab Advisor Services.

Charles Schwab & Co., Inc. and Charles Schwab Bank are separate but affiliated companies and subsidiaries of The Charles Schwab Corporation. Brokerage products, including the Schwab One® brokerage account, are offered by Charles Schwab & Co., Inc., Member SIPC. Deposit and lending products are offered by Charles Schwab Bank, Member FDIC and an Equal Housing Lender.

Schwab affiliates earn revenue from the underlying assets in Institutional Intelligent Portfolios® accounts. This revenue comes from managing Schwab ETFs™ or Schwab Funds® and providing services relating to certain third-party funds that can be selected for the portfolio, and from the cash feature on the accounts. Revenue may also be received from the market centers where ETF trade orders are routed for execution. Tax-loss harvesting is available for clients with invested assets of $50,000 or more in their Institutional Intelligent Portfolios account. Clients must be enrolled to receive this service. Cash balances held in the Sweep Program at Schwab Bank are eligible for FDIC insurance up to allowable limits per depositor, per account ownership category.