What's New in Schwab Tech

Below you can explore the latest tools, technology, and resources available on Schwab Advisor Center®. Click through the articles to see the most recent enhancements or dive deeper by clicking a topic on the navigation bar.

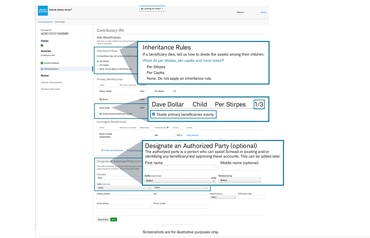

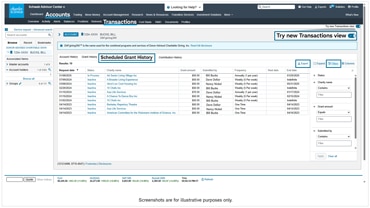

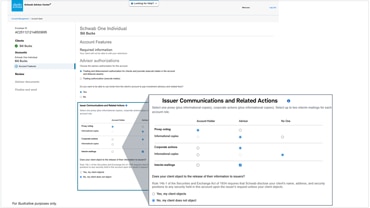

Update your authority level on client accounts digitally

The digital account maintenance workflow now lets your clients eAuthorize changes to your authority level on their accounts.

Webcast: How advisors are blending model portfolios | March 24 at 10 a.m. PT

Join Schwab professionals and leading model providers for an overview of Model Market Center™, which provides access to hundreds of models from recognized money managers. Learn how advisors are using the platform to create blended model portfolios tailored specifically to their clients.

Related resources

For general educational and informational purposes only.

Schwab Advisor Center is a website of Charles Schwab & Co., Inc. (Schwab) for the use of independent investment advisor clients that custody assets with Schwab.

This material is for registered investment advisor use only. This material may not be forwarded or made available, in part or in whole, to any party who is not a financial professional.

Charles Schwab & Co., Inc., Charles Schwab Bank, SSB and Charles Schwab Premier Bank, SSB are separate but affiliated companies and subsidiaries of The Charles Schwab Corporation. Deposit and lending products are offered by Charles Schwab Bank, SSB, Member FDIC and an Equal Housing Lender, and Charles Schwab Premier Bank, SSB, Member FDIC.

Investment and Insurance Products Are: Not FDIC Insured • Not Insured by Any Federal Government Agency • Not a Deposit or Other Obligation of, or Guaranteed by, the Bank or Any of Its Affiliates • Subject to Investment Risks, Including Possible Loss of Principal Amount Invested.